Page 278 - ACFE Fraud Reports 2009_2020

P. 278

Victim organizations

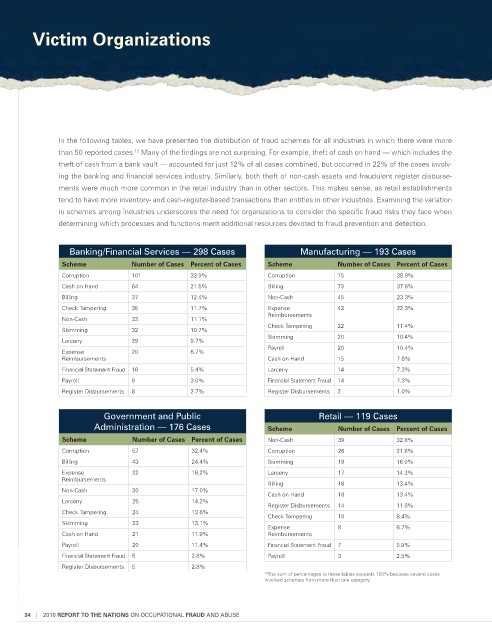

In the following tables, we have presented the distribution of fraud schemes for all industries in which there were more

than 50 reported cases. Many of the findings are not surprising. For example, theft of cash on hand — which includes the

12

theft of cash from a bank vault — accounted for just 12% of all cases combined, but occurred in 22% of the cases involv-

ing the banking and financial services industry. Similarly, both theft of non-cash assets and fraudulent register disburse-

ments were much more common in the retail industry than in other sectors. This makes sense, as retail establishments

tend to have more inventory- and cash-register-based transactions than entities in other industries. Examining the variation

in schemes among industries underscores the need for organizations to consider the specific fraud risks they face when

determining which processes and functions merit additional resources devoted to fraud prevention and detection.

banking/Financial Services — 298 cases Manufacturing — 193 cases

scheme Number of Cases percent of Cases scheme Number of Cases percent of Cases

Corruption 101 33.9% Corruption 75 38.9%

Cash on Hand 64 21.5% Billing 73 37.8%

Billing 37 12.4% Non-Cash 45 23.3%

Check Tampering 35 11.7% Expense 43 22.3%

Reimbursements

Non-Cash 33 11.1%

Check Tampering 22 11.4%

Skimming 32 10.7%

Skimming 20 10.4%

Larceny 29 9.7%

Payroll 20 10.4%

Expense 20 6.7%

Reimbursements Cash on Hand 15 7.8%

Financial Statement Fraud 16 5.4% Larceny 14 7.3%

Payroll 9 3.0% Financial Statement Fraud 14 7.3%

Register Disbursements 8 2.7% Register Disbursements 2 1.0%

Government and Public Retail — 119 cases

Administration — 176 cases scheme Number of Cases percent of Cases

scheme Number of Cases percent of Cases Non-Cash 39 32.8%

Corruption 57 32.4% Corruption 26 21.8%

Billing 43 24.4% Skimming 19 16.0%

Expense 32 18.2% Larceny 17 14.3%

Reimbursements

Billing 16 13.4%

Non-Cash 30 17.0%

Cash on Hand 16 13.4%

Larceny 25 14.2%

Register Disbursements 14 11.8%

Check Tampering 24 13.6%

Check Tampering 10 8.4%

Skimming 23 13.1%

Expense 8 6.7%

Cash on Hand 21 11.9% Reimbursements

Payroll 20 11.4% Financial Statement Fraud 7 5.9%

Financial Statement Fraud 5 2.8% Payroll 3 2.5%

Register Disbursements 5 2.8%

12 The sum of percentages in these tables exceeds 100% because several cases

involved schemes from more than one category.

34 | 2010 RepoRt to the NAtioNs ON OccuPATIONAl FRAUD ANd AbuSE