Page 93 - Interest Income - Individuals Handbook

P. 93

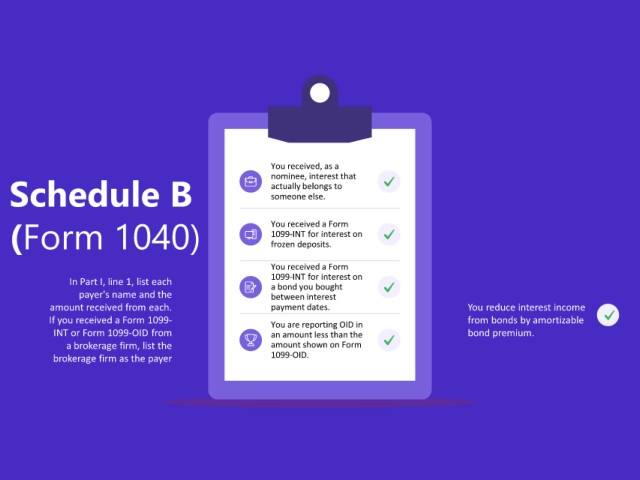

You received, as a

nominee, interest that

Schedule B actually belongs to

someone else.

You received a Form

(Form 1040) 1099-INT for interest on

frozen deposits.

You received a Form

In Part I, line 1, list each 1099-INT for interest on

a bond you bought

payer's name and the between interest

amount received from each. payment dates. You reduce interest income

If you received a Form 1099- You are reporting OID in from bonds by amortizable

INT or Form 1099-OID from an amount less than the bond premium.

a brokerage firm, list the amount shown on Form

brokerage firm as the payer 1099-OID.