Page 97 - Interest Income - Individuals Handbook

P. 97

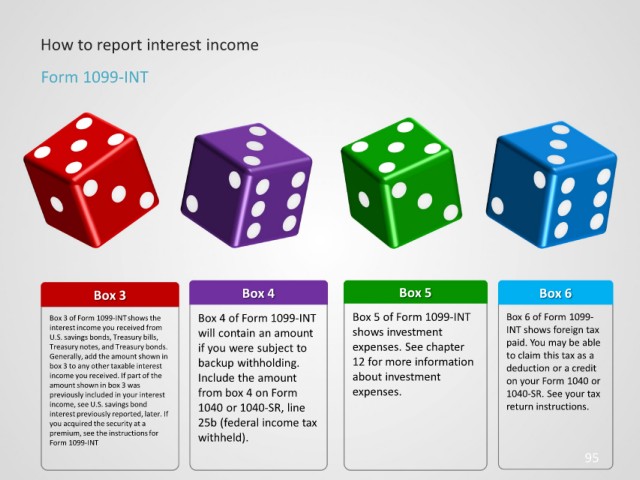

How to report interest income

Form 1099-INT

Box 3 Box 4 Box 5 Box 6

Box 3 of Form 1099-INT shows the Box 4 of Form 1099-INT Box 5 of Form 1099-INT Box 6 of Form 1099-

interest income you received from shows investment INT shows foreign tax

U.S. savings bonds, Treasury bills, will contain an amount

Treasury notes, and Treasury bonds. if you were subject to expenses. See chapter paid. You may be able

Generally, add the amount shown in 12 for more information to claim this tax as a

box 3 to any other taxable interest backup withholding. deduction or a credit

income you received. If part of the Include the amount about investment

amount shown in box 3 was on your Form 1040 or

previously included in your interest from box 4 on Form expenses. 1040-SR. See your tax

income, see U.S. savings bond 1040 or 1040-SR, line return instructions.

interest previously reported, later. If

you acquired the security at a 25b (federal income tax

premium, see the instructions for withheld).

Form 1099-INT

95