Page 95 - Interest Income - Individuals Handbook

P. 95

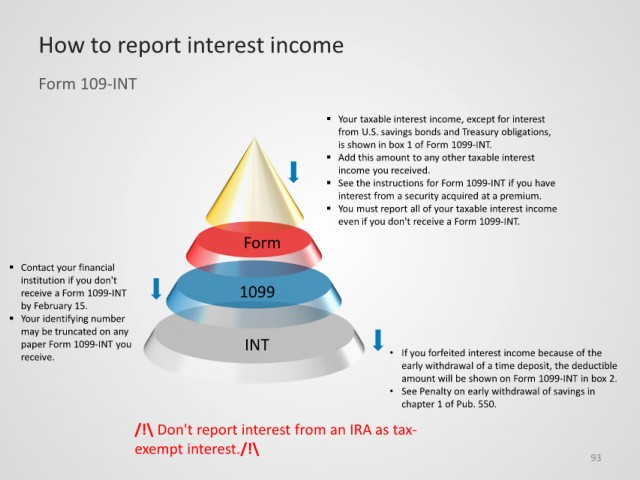

How to report interest income

Form 109-INT

Your taxable interest income, except for interest

from U.S. savings bonds and Treasury obligations,

is shown in box 1 of Form 1099-INT.

Add this amount to any other taxable interest

income you received.

See the instructions for Form 1099-INT if you have

interest from a security acquired at a premium.

You must report all of your taxable interest income

even if you don't receive a Form 1099-INT.

Form

Contact your financial

institution if you don't

receive a Form 1099-INT 1099

by February 15.

Your identifying number

may be truncated on any

paper Form 1099-INT you INT

receive. • If you forfeited interest income because of the

early withdrawal of a time deposit, the deductible

amount will be shown on Form 1099-INT in box 2.

• See Penalty on early withdrawal of savings in

chapter 1 of Pub. 550.

/!\ Don't report interest from an IRA as tax-

exempt interest./!\

93