Page 35 - Keeping Business Records

P. 35

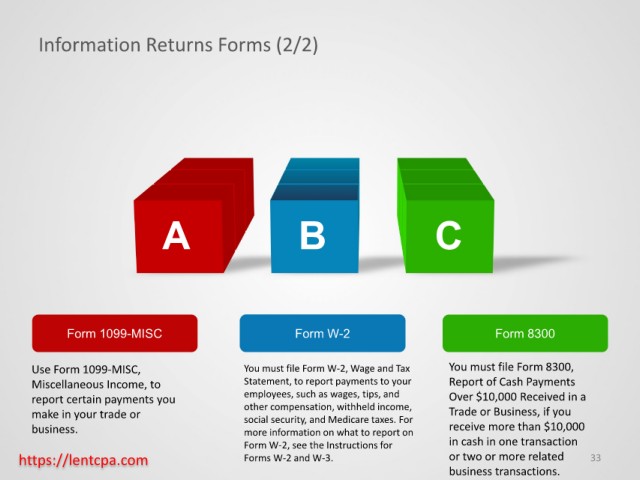

Information Returns Forms (2/2)

A B C

Form 1099-MISC Form W-2 Form 8300

Use Form 1099-MISC, You must file Form W-2, Wage and Tax You must file Form 8300,

Miscellaneous Income, to Statement, to report payments to your Report of Cash Payments

report certain payments you employees, such as wages, tips, and Over $10,000 Received in a

other compensation, withheld income,

make in your trade or social security, and Medicare taxes. For Trade or Business, if you

business. more information on what to report on receive more than $10,000

Form W-2, see the Instructions for in cash in one transaction

https://lentcpa.com Forms W-2 and W-3. or two or more related 33

business transactions.