Page 37 - Keeping Business Records

P. 37

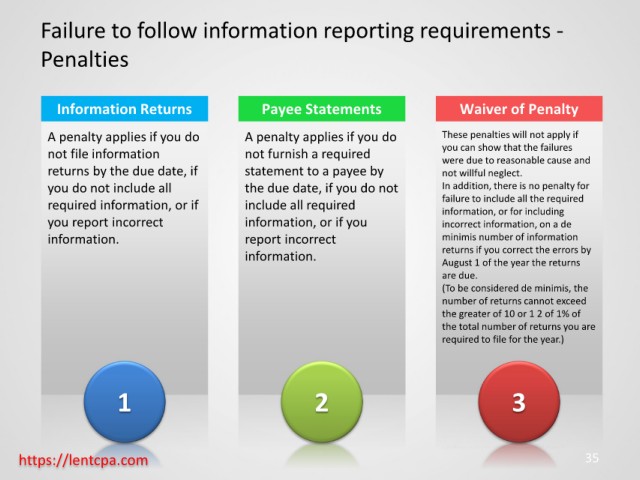

Failure to follow information reporting requirements -

Penalties

Information Returns Payee Statements Waiver of Penalty

A penalty applies if you do A penalty applies if you do These penalties will not apply if

not file information not furnish a required you can show that the failures

were due to reasonable cause and

returns by the due date, if statement to a payee by not willful neglect.

you do not include all the due date, if you do not In addition, there is no penalty for

required information, or if include all required failure to include all the required

information, or for including

you report incorrect information, or if you incorrect information, on a de

information. report incorrect minimis number of information

information. returns if you correct the errors by

August 1 of the year the returns

are due.

(To be considered de minimis, the

number of returns cannot exceed

the greater of 10 or 1 2 of 1% of

the total number of returns you are

required to file for the year.)

1 2 3

https://lentcpa.com 35