Page 36 - Keeping Business Records

P. 36

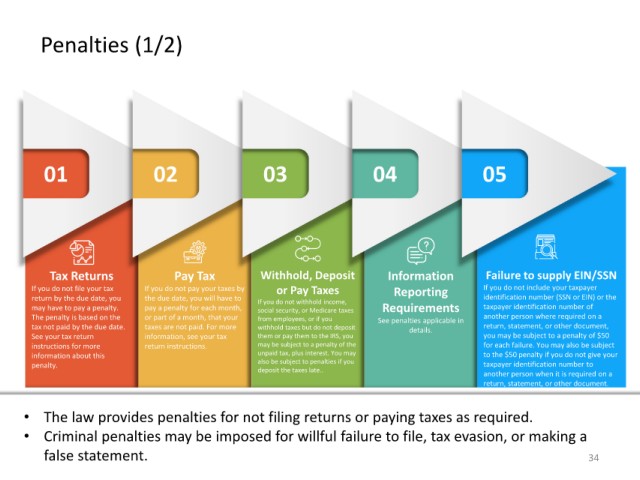

Penalties (1/2)

01 02 03 04 05

Tax Returns Pay Tax Withhold, Deposit Information Failure to supply EIN/SSN

If you do not file your tax If you do not pay your taxes by or Pay Taxes Reporting If you do not include your taxpayer

return by the due date, you the due date, you will have to If you do not withhold income, identification number (SSN or EIN) or the

may have to pay a penalty. pay a penalty for each month, social security, or Medicare taxes Requirements taxpayer identification number of

The penalty is based on the or part of a month, that your from employees, or if you See penalties applicable in another person where required on a

tax not paid by the due date. taxes are not paid. For more withhold taxes but do not deposit details. return, statement, or other document,

See your tax return information, see your tax them or pay them to the IRS, you you may be subject to a penalty of $50

instructions for more return instructions. may be subject to a penalty of the for each failure. You may also be subject

information about this unpaid tax, plus interest. You may to the $50 penalty if you do not give your

penalty. also be subject to penalties if you taxpayer identification number to

deposit the taxes late.. another person when it is required on a

return, statement, or other document.

• The law provides penalties for not filing returns or paying taxes as required.

• Criminal penalties may be imposed for willful failure to file, tax evasion, or making a

false statement. 34