Page 41 - Wages, Salaries and Other Earnings

P. 41

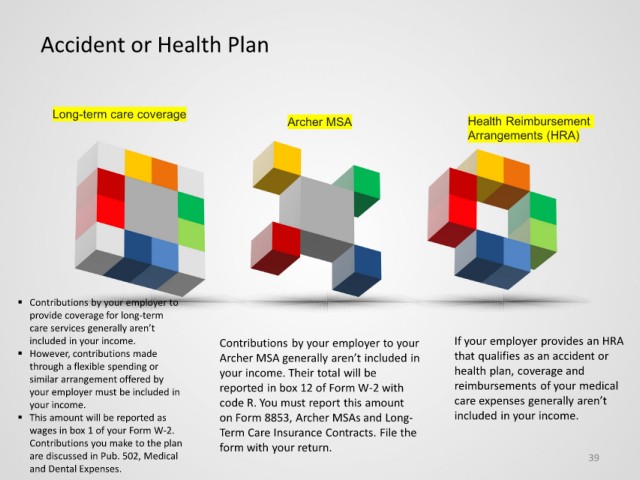

Accident or Health Plan

Long-term care coverage

Archer MSA Health Reimbursement

Arrangements (HRA)

Contributions by your employer to

provide coverage for long-term

care services generally aren’t

included in your income. Contributions by your employer to your If your employer provides an HRA

However, contributions made Archer MSA generally aren’t included in that qualifies as an accident or

through a flexible spending or your income. Their total will be health plan, coverage and

similar arrangement offered by reimbursements of your medical

your employer must be included in reported in box 12 of Form W-2 with

your income. code R. You must report this amount care expenses generally aren’t

This amount will be reported as on Form 8853, Archer MSAs and Long- included in your income.

wages in box 1 of your Form W-2. Term Care Insurance Contracts. File the

Contributions you make to the plan form with your return.

are discussed in Pub. 502, Medical 39

and Dental Expenses.