Page 64 - Wages, Salaries and Other Earnings

P. 64

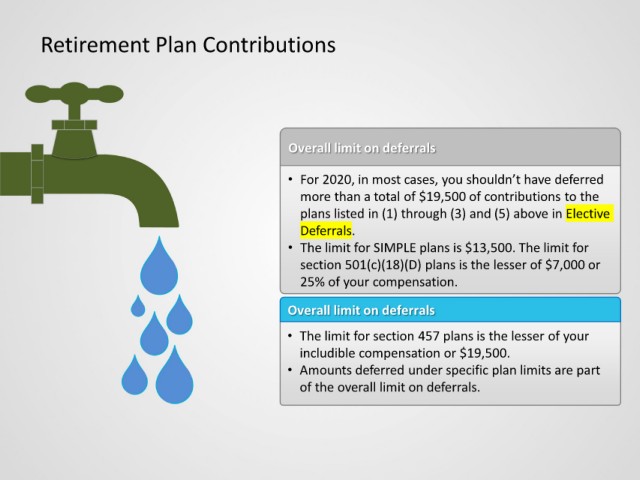

Retirement Plan Contributions

Overall limit on deferrals

• For 2020, in most cases, you shouldn’t have deferred

more than a total of $19,500 of contributions to the

plans listed in (1) through (3) and (5) above in Elective

Deferrals.

• The limit for SIMPLE plans is $13,500. The limit for

section 501(c)(18)(D) plans is the lesser of $7,000 or

25% of your compensation.

Overall limit on deferrals

• The limit for section 457 plans is the lesser of your

includible compensation or $19,500.

• Amounts deferred under specific plan limits are part

of the overall limit on deferrals.