Page 66 - Wages, Salaries and Other Earnings

P. 66

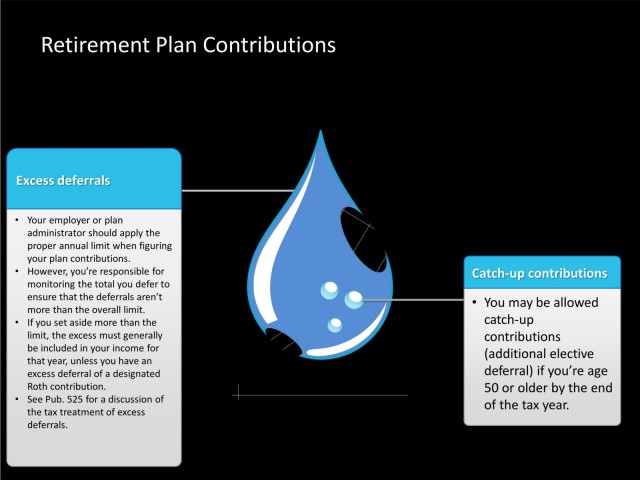

Retirement Plan Contributions

Excess deferrals

• Your employer or plan

administrator should apply the

proper annual limit when figuring

your plan contributions.

• However, you’re responsible for Catch-up contributions

monitoring the total you defer to

ensure that the deferrals aren’t • You may be allowed

more than the overall limit.

• If you set aside more than the catch-up

limit, the excess must generally contributions

be included in your income for (additional elective

that year, unless you have an

excess deferral of a designated deferral) if you’re age

Roth contribution. 50 or older by the end

• See Pub. 525 for a discussion of of the tax year.

the tax treatment of excess

deferrals.