Page 71 - Wages, Salaries and Other Earnings

P. 71

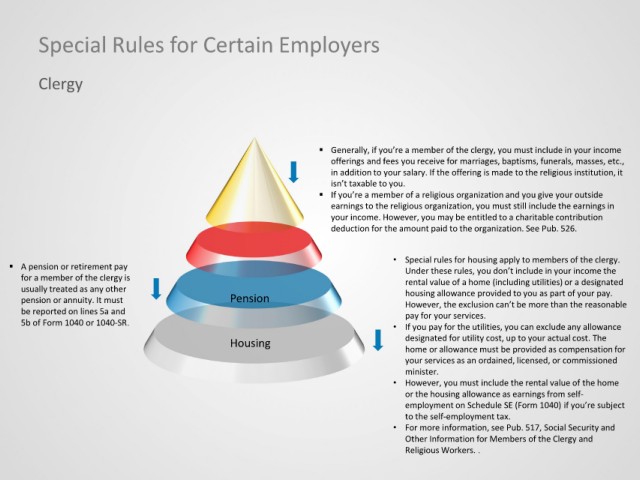

Special Rules for Certain Employers

Clergy

Generally, if you’re a member of the clergy, you must include in your income

offerings and fees you receive for marriages, baptisms, funerals, masses, etc.,

in addition to your salary. If the offering is made to the religious institution, it

isn’t taxable to you.

If you’re a member of a religious organization and you give your outside

earnings to the religious organization, you must still include the earnings in

your income. However, you may be entitled to a charitable contribution

deduction for the amount paid to the organization. See Pub. 526.

• Special rules for housing apply to members of the clergy.

A pension or retirement pay Under these rules, you don’t include in your income the

for a member of the clergy is rental value of a home (including utilities) or a designated

usually treated as any other housing allowance provided to you as part of your pay.

pension or annuity. It must Pension However, the exclusion can’t be more than the reasonable

be reported on lines 5a and pay for your services.

5b of Form 1040 or 1040-SR. • If you pay for the utilities, you can exclude any allowance

Housing designated for utility cost, up to your actual cost. The

home or allowance must be provided as compensation for

your services as an ordained, licensed, or commissioned

minister.

• However, you must include the rental value of the home

or the housing allowance as earnings from self-

employment on Schedule SE (Form 1040) if you’re subject

to the self-employment tax.

• For more information, see Pub. 517, Social Security and

Other Information for Members of the Clergy and

Religious Workers. .