Page 68 - Wages, Salaries and Other Earnings

P. 68

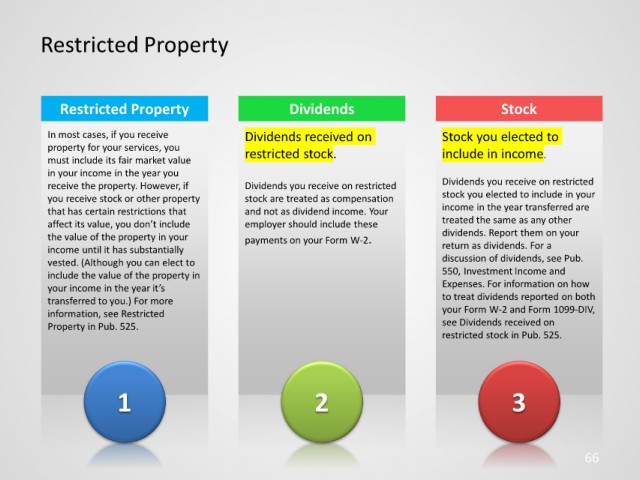

Restricted Property

Restricted Property Dividends Stock

In most cases, if you receive Dividends received on Stock you elected to

property for your services, you restricted stock.

must include its fair market value include in income.

in your income in the year you

receive the property. However, if Dividends you receive on restricted Dividends you receive on restricted

you receive stock or other property stock are treated as compensation stock you elected to include in your

that has certain restrictions that and not as dividend income. Your income in the year transferred are

affect its value, you don’t include employer should include these treated the same as any other

the value of the property in your payments on your Form W-2. dividends. Report them on your

income until it has substantially return as dividends. For a

vested. (Although you can elect to discussion of dividends, see Pub.

include the value of the property in 550, Investment Income and

your income in the year it’s Expenses. For information on how

transferred to you.) For more to treat dividends reported on both

information, see Restricted your Form W-2 and Form 1099-DIV,

Property in Pub. 525. see Dividends received on

restricted stock in Pub. 525.

1 2 3

66