Page 174 - Adopt-a-School Foundation 2016-2017 Annual Report

P. 174

ADOPT-A-SCHOOL FOUNDATION NPC

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

for the year ended 30 June 2017

3 financial instruments (continued)

financial assets at fair value through profit and loss

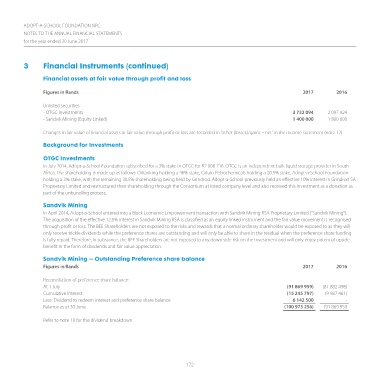

Figures in Rands 2017 2016

Unlisted securities

- OTGC Investments 3 732 094 2 097 924

- Sandvik Mining (Equity Linked) 1 400 000 1 800 000

Changes in fair value of financial assets at fair value through profit or loss are recorded in ‘other (losses)/gains – net’ in the income statement (note 12)

background for investments

otgc investments

In July 2014, Adopt-a-School Foundation subscribed for a 3% stake in OTGC for R2 008 716. OTGC is an independent bulk liquid storage provider in South

Africa. The shareholding is made up as follows: Oiltanking holding a 46% stake, Calulo Petrochemicals holding a 20.5% stake, Adopt-a-School Foundation

holding a 3% stake, with the remaining 30.5% shareholding being held by Grindrod. Adopt-a-School previously held an effective 10% interest in Grindrod SA

Proprietary Limited and restructured their shareholding through the Consortium at listed company level and also received this investment as a donation as

part of the unbundling process.

sandvik mining

In April 2014, Adopt-a-School entered into a Black Economic Empowerment transaction with Sandvik Mining RSA Proprietary Limited (“Sandvik Mining”).

The acquisition of the effective 12.5% interest in Sandvik Mining RSA is classified as an equity linked instrument and the fair value movement is recognised

through profit or loss. The BEE Shareholders are not exposed to the risks and rewards that a normal ordinary shareholder would be exposed to as they will

only receive trickle dividends while the preference shares are outstanding and will only be able to share in the residual when the preference share funding

is fully repaid. Therefore, in substance, the BEE Shareholders are not exposed to any down side risk on the investment and will only enjoy potential upside

benefit in the form of dividends and fair value appreciation.

sandvik mining – outstanding preference share balance

Figures in Rands 2017 2016

Reconciliation of preference share balance:

At 1 July (91 869 959) (81 882 498)

Cumulative Interest (15 245 797) (9 987 461)

Less: Dividend to redeem interest and preference share balance 6 142 500 -

Balance as at 30 June (100 973 256) (91 869 959

Refer to note 10 for the dividend breakdown

172