Page 175 - Adopt-a-School Foundation 2016-2017 Annual Report

P. 175

ADOPT-A-SCHOOL FOUNDATION NPC

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

for the year ended 30 June 2017

3 financial instruments (continued)

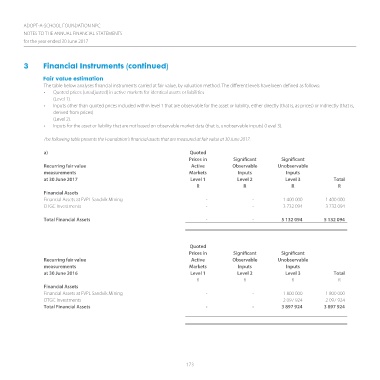

fair value estimation

The table below analyses financial instruments carried at fair value, by valuation method. The different levels have been defined as follows:

• Quoted prices (unadjusted) in active markets for identical assets or liabilities

(Level 1).

• Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is,

derived from prices)

(Level 2).

• Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs) (Level 3).

The following table presents the Foundation’s financial assets that are measured at fair value at 30 June 2017.

a) Quoted

Prices in Significant Significant

Recurring fair value Active Observable unobservable

measurements Markets Inputs Inputs

at 30 June 2017 Level 1 Level 2 Level 3 Total

R R R R

Financial Assets

Financial Assets at FVPL Sandvik Mining - - 1 400 000 1 400 000

OTGC Investments - - 3 732 094 3 732 094

Total Financial Assets - - 5 132 094 5 132 094

Quoted

Prices in Significant Significant

Recurring fair value Active Observable unobservable

measurements Markets Inputs Inputs

at 30 June 2016 Level 1 Level 2 Level 3 Total

R R R R

Financial Assets

Financial Assets at FVPL Sandvik Mining - - 1 800 000 1 800 000

OTGC Investments - - 2 097 924 2 097 924

Total Financial Assets - - 3 897 924 3 897 924

173