Page 8 - 2022 November Report

P. 8

November Report 2022

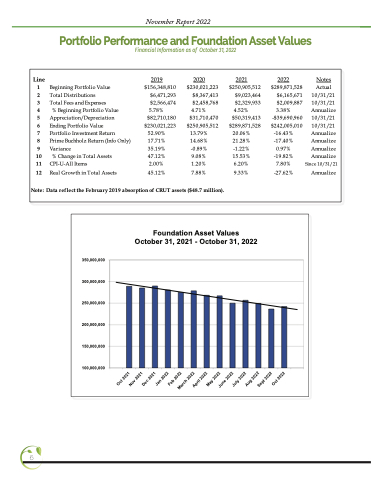

Portfolio Performance and Foundation Asset Values

FinancialInformationasof October31,2022

Line

1 Beginning Portfolio Value

2 Total Distributions

3 Total Fees and Expenses

4 % Beginning Portfolio Value

5 Appreciation/Depreciation $82,710,180

6 Ending Portfolio Value

7 Portfolio Investment Return

8 Prime Buchholz Return (Info Only)

9 Variance

10 % Change in Total Assets

11 CPI-U-All Items

12 Real Growth in Total Assets

$230,021,223 52.90% 17.71% 35.19% 47.12%

2.00% 45.12%

Note: Data reflect the February 2019 absorption of CRUT assets ($48.7 million).

2019 $156,348,810

2020 $230,021,223

$8,367,413

$2,458,768 4.71%

$31,710,470 $250,905,512

13.79% 14.68% -0.89% 9.08% 1.20% 7.88%

2021 $250,905,512

$9,023,464

$2,329,933 4.52%

$50,319,413 $289,871,528

20.06% 21.28% -1.22% 15.53% 6.20% 9.33%

2022 $289,871,528

$6,165,671 $2,009,887 3.38%

-$39,690,960 $242,005,010

-16.43% -17.40% 0.97% -19.82% 7.80% -27.62%

Notes Actual 10/31/21 10/31/21 Annualize 10/31/21 10/31/21 Annualize Annualize Annualize Annualize

Since 10/31/21 Annualize

$6,471,293

$2,566,474 5.78%

350,000,000 300,000,000 250,000,000 200,000,000 150,000,000 100,000,000

Oct 2021

Nov 2021

Dec 2021

Jan 2022

Feb 2022

May 2022

Aug 2022

March 2022

April 2022

June 2022

July 2022

Sept 2022

Oct 2022

Foundation Asset Values October 31, 2021 - October 31, 2022

6