Page 229 - CA Final GST

P. 229

Badlani Classes

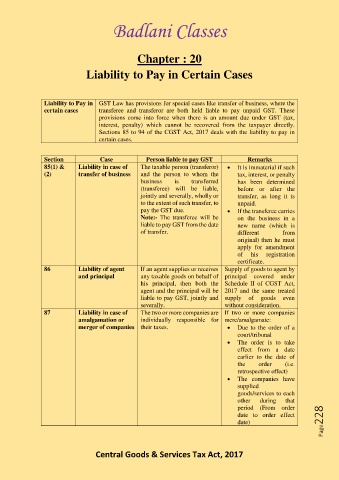

Chapter : 20

Liability to Pay in Certain Cases

Liability to Pay in GST Law has provisions for special cases like transfer of business, where the

certain cases transferee and transferor are both held liable to pay unpaid GST. These

provisions come into force when there is an amount due under GST (tax,

interest, penalty) which cannot be recovered from the taxpayer directly.

Sections 85 to 94 of the CGST Act, 2017 deals with the liability to pay in

certain cases.

Section Case Person liable to pay GST Remarks

85(1) & Liability in case of The taxable person (transferor) • It is immaterial if such

(2) transfer of business and the person to whom the tax, interest, or penalty

business is transferred has been determined

(transferee) will be liable, before or after the

jointly and severally, wholly or transfer, as long it is

to the extent of such transfer, to unpaid.

pay the GST due. • If the transferee carries

Note:- The transferee will be on the business in a

liable to pay GST from the date new name (which is

of transfer. different from

original) then he must

apply for amendment

of his registration

certificate.

86 Liability of agent If an agent supplies or receives Supply of goods to agent by

and principal any taxable goods on behalf of principal covered under

his principal, then both the Schedule II of CGST Act,

agent and the principal will be 2017 and the same treated

liable to pay GST, jointly and supply of goods even

severally. without consideration.

87 Liability in case of The two or more companies are If two or more companies

amalgamation or individually responsible for mere/amalgamate:

merger of companies their taxes. • Due to the order of a

court/tribunal

• The order is to take

effect from a date

earlier to the date of

the order (i.e.

retrospective effect)

• The companies have

supplied

goods/services to each

other during that

period (From order

date to order effect

date) Page228

Central Goods & Services Tax Act, 2017