Page 230 - CA Final GST

P. 230

Badlani Classes

Such companies shall be

treated as distinct

companies under GST till

the date of the order (and

not order effect date). Their

registrations will get

cancelled on the date of

order.

Example: X Ltd and Y Ltd

has received a court order

on 15 December 2017 to

th

st

merge with effect from 1

October 2017.

Under GST they will be

treated as distinct

companies till 15

th

December 2017 and each

one will be responsible for

th

its own dues until 15

December 2017.

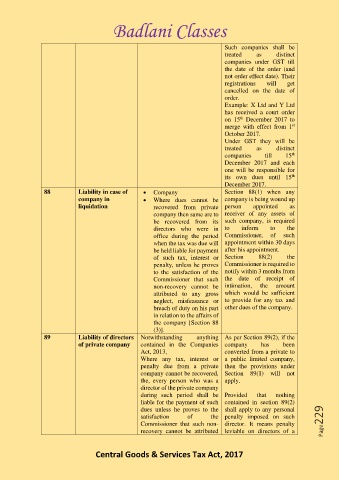

88 Liability in case of • Company Section 88(1) when any

company in • Where dues cannot be company is being wound up

liquidation recovered from private person appointed as

company then same are to receiver of any assets of

be recovered from its such company, is required

directors who were in to inform to the

office during the period Commissioner, of such

when the tax was due will appointment within 30 days

be held liable for payment after his appointment.

of such tax, interest or Section 88(2) the

penalty, unless he proves Commissioner is required to

to the satisfaction of the notify within 3 months from

Commissioner that such the date of receipt of

non-recovery cannot be intimation, the amount

attributed to any gross which would be sufficient

neglect, misfeasance or to provide for any tax and

breach of duty on his part other dues of the company.

in relation to the affairs of

the company [Section 88

(3)].

89 Liability of directors Notwithstanding anything As per Section 89(2), if the

of private company contained in the Companies company has been

Act, 2013, converted from a private to

Where any tax, interest or a public limited company,

penalty due from a private then the provisions under

company cannot be recovered, Section 89(1) will not

the, every person who was a apply.

director of the private company

during such period shall be Provided that nothing

liable for the payment of such contained in section 89(2)

dues unless he proves to the shall apply to any personal

satisfaction of the penalty imposed on such

Commissioner that such non- director. It means penalty Page229

recovery cannot be attributed leviable on directors of a

Central Goods & Services Tax Act, 2017