Page 232 - CA Final GST

P. 232

Badlani Classes

even though ` 15,000 was

incurred after he had retired.

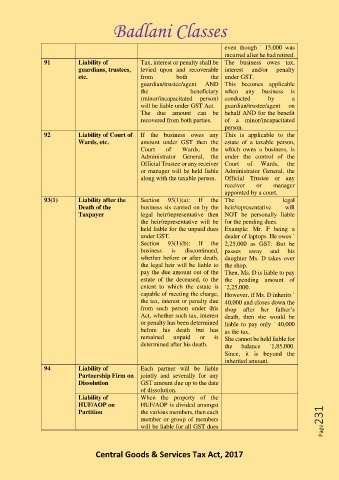

91 Liability of Tax, interest or penalty shall be The business owes tax,

guardians, trustees, levied upon and recoverable interest and/or penalty

etc. from both the under GST.

guardian/trustee/agent AND This becomes applicable

the beneficiary when any business is

(minor/incapacitated person) conducted by a

will be liable under GST Act. guardian/trustee/agent on

The due amount can be behalf AND for the benefit

recovered from both parties. of a minor/incapacitated

person.

92 Liability of Court of If the business owes any This is applicable to the

Wards, etc. amount under GST then the estate of a taxable person,

Court of Wards, the which owns a business, is

Administrator General, the under the control of the

Official Trustee or any receiver Court of Wards, the

or manager will be held liable Administrator General, the

along with the taxable person. Official Trustee or any

receiver or manager

appointed by a court.

93(1) Liability after the Section 93(1)(a): If the The legal

Death of the business sis carried on by the heir/representative will

Taxpayer legal heir/representative then NOT be personally liable

the heir/representative will be for the pending dues.

held liable for the unpaid dues Example: Mr. F being a

under GST. dealer of laptops. He owes `

Section 93(1)(b): If the 2,25,000 as GST. But he

business is discontinued, passes away and his

whether before or after death, daughter Ms. D takes over

the legal heir will be liable to the shop.

pay the due amount out of the Then, Ms. D is liable to pay

estate of the deceased, to the the pending amount of

extent to which the estate is `2,25,000.

capable of meeting the charge, However, if Ms. D inherits `

the tax, interest or penalty due 40,000 and closes down the

from such person under this shop after her father’s

Act, whether such tax, interest death, then she would be

or penalty has been determined liable to pay only ` 40,000

before his death but has as the tax.

remained unpaid or is She cannot be held liable for

determined after his death. the balance `1,85,000.

Since, it is beyond the

inherited amount.

94 Liability of Each partner will be liable

Partnership Firm on jointly and severally for any

Dissolution GST amount due up to the date

of dissolution.

Liability of When the property of the

HUF/AOP on HUF/AOP is divided amongst

Partition the various members, then each

member or group of members Page231

will be liable for all GST dues

Central Goods & Services Tax Act, 2017