Page 76 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 76

62 Don’t Make Me Say I Told You So

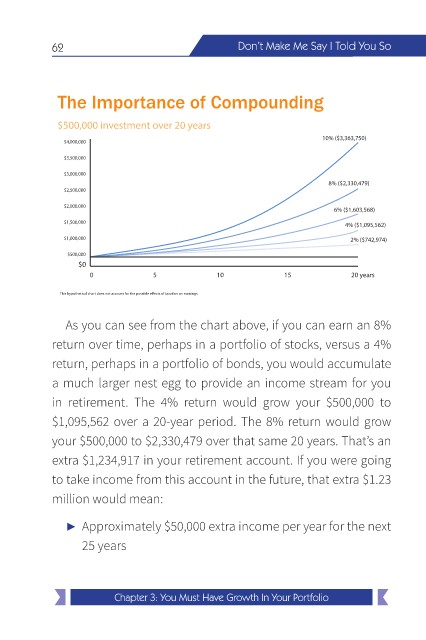

The Importance of Compounding

$500,000 investment over 20 years

10% ($3,363,750)

$4,000,000

$3,500,000

$3,000,000

8% ($2,330,479)

$2,500,000

$2,000,000

6% ($1,603,568)

$1,500,000 4% ($1,095,562)

$1,000,000 2% ($742,974)

$500,000

$0

0 5 10 15 20 years

This hypothetical chart does not account for the possible e ects of taxation on earnings.

As you can see from the chart above, if you can earn an 8%

return over time, perhaps in a portfolio of stocks, versus a 4%

return, perhaps in a portfolio of bonds, you would accumulate

a much larger nest egg to provide an income stream for you

in retirement. The 4% return would grow your $500,000 to

$1,095,562 over a 20-year period. The 8% return would grow

your $500,000 to $2,330,479 over that same 20 years. That’s an

extra $1,234,917 in your retirement account. If you were going

to take income from this account in the future, that extra $1.23

million would mean:

► Approximately $50,000 extra income per year for the next

25 years

Chapter 3: You Must Have Growth In Your Portfolio