Page 73 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 73

Don’t Make Me Say I Told You So 59

Investment Return Needed

Living Expenses

5% - 7%

Which investments have the 8% to 12%

potential for this type of return? Return

Needed

In ation

3% - 5%

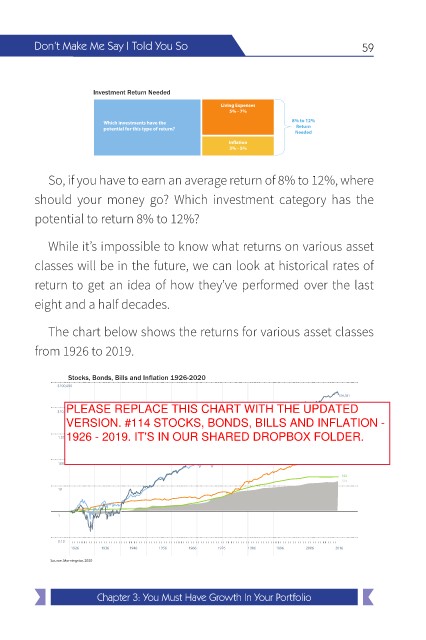

So, if you have to earn an average return of 8% to 12%, where

should your money go? Which investment category has the

potential to return 8% to 12%?

While it’s impossible to know what returns on various asset

classes will be in the future, we can look at historical rates of

return to get an idea of how they’ve performed over the last

eight and a half decades.

The chart below shows the returns for various asset classes

from 1926 to 2019.

Stocks, Bonds, Bills and Inflation 1926-2020

$100,000

$39,381

$10,000 PLEASE REPLACE THIS CHART WITH THE UPDATED

$9,244

VERSION. #114 STOCKS, BONDS, BILLS AND INFLATION -

Compound annual return

1926 - 2019. IT'S IN OUR SHARED DROPBOX FOLDER.

Small stocks

11.9%

1,000 Large Stocks 10.0

Government bonds 5.5

Treasury bills 3.3

In ation 2.9 $159

100

$22

$14

10

1

0.10

1926 1936 1946 1956 1966 1976 1986 1996 2006 2016

Source: Morningstar, 2020

Chapter 3: You Must Have Growth In Your Portfolio