Page 69 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 69

Don’t Make Me Say I Told You So 55

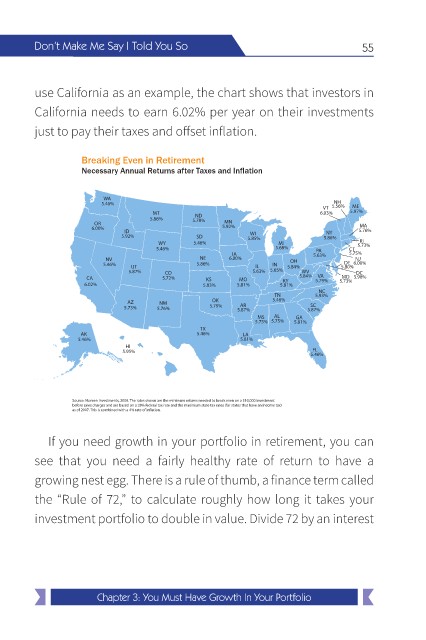

use California as an example, the chart shows that investors in

California needs to earn 6.02% per year on their investments

just to pay their taxes and offset inflation.

Breaking Even in Retirement

Necessary Annual Returns after Taxes and Inflation

WA

NH

5.46% VT 5.56% ME

MT ND 6.03% 5.97%

5.86% 5.78%

OR MN

MA

6.00% ID 5.92% 5.76%

NY

WI

5.92% SD 5.85% 5.86%

RI

WY 5.46% MI 5.73%

5.46% 5.68% PA CT

IA 5.63% 5.75%

NV NE 6.00% OH NJ

DE 6.00%

5.46% UT 5.86% IL IN 5.84% 5.80%

5.87% CO 5.63% 5.65% WV DC

VA

CA 5.72% KS MO 5.84% 5.79% MD 5.98%

KY

6.02% 5.83% 5.81% 5.81% 5.73%

NC

TN 5.93%

AZ NM OK 5.46%

SC

AR

5.73% 5.76% 5.79% 5.87% 5.87%

MS AL GA

5.75% 5.75% 5.81%

TX

AK 5.46% LA

5.46% 5.81%

HI

5.95% FL

5.46%

Source: Nuveen Investments, 2008. The rates shown are the minimum returns needed to break even on a $10,000 investment

before sales charges and are based on a 28% federal tax rate and the maximum state tax rates (for states that have an income tax)

as of 2007. This is combined with a 4% rate of in ation.

If you need growth in your portfolio in retirement, you can

see that you need a fairly healthy rate of return to have a

growing nest egg. There is a rule of thumb, a finance term called

the “Rule of 72,” to calculate roughly how long it takes your

investment portfolio to double in value. Divide 72 by an interest

Chapter 3: You Must Have Growth In Your Portfolio