Page 90 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 90

Section 5

Stocks vs. Bonds or Fixed-Income

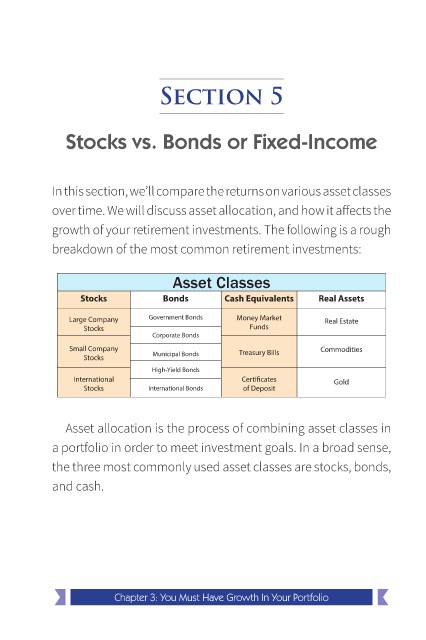

In this section, we’ll compare the returns on various asset classes

over time. We will discuss asset allocation, and how it affects the

growth of your retirement investments. The following is a rough

breakdown of the most common retirement investments:

Asset Classes

Stocks Bonds Cash Equivalents Real Assets

Large Company Government Bonds Money Market Real Estate

Stocks Funds

Corporate Bonds

Small Company Treasury Bills Commodities

Stocks Municipal Bonds

High-Yield Bonds

International Certi cates Gold

Stocks International Bonds of Deposit

Asset allocation is the process of combining asset classes in

a portfolio in order to meet investment goals. In a broad sense,

the three most commonly used asset classes are stocks, bonds,

and cash.

Chapter 3: You Must Have Growth In Your Portfolio