Page 94 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 94

80 Don’t Make Me Say I Told You So

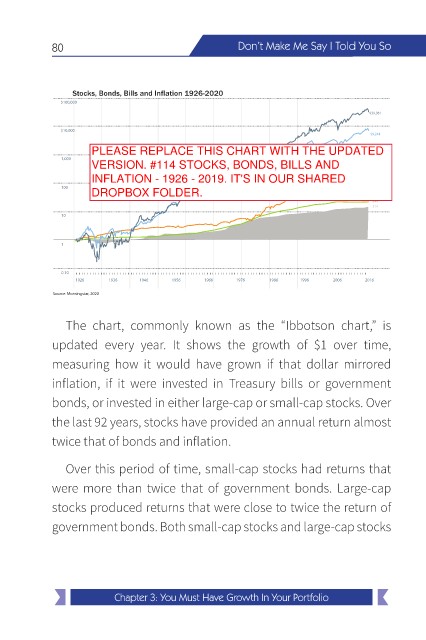

Stocks, Bonds, Bills and Inflation 1926-2020

$100,000

$39,381

$10,000

$9,244

Compound annual return

PLEASE REPLACE THIS CHART WITH THE UPDATED

1,000 Small stocks 11.9%

Large Stocks

VERSION. #114 STOCKS, BONDS, BILLS AND

10.0

5.5

Government bonds

Treasury bills 3.3

INFLATION - 1926 - 2019. IT'S IN OUR SHARED $159

2.9

In ation

100

DROPBOX FOLDER.

$22

$14

10

1

0.10

1926 1936 1946 1956 1966 1976 1986 1996 2006 2016

Source: Morningstar, 2020

The chart, commonly known as the “Ibbotson chart,” is

updated every year. It shows the growth of $1 over time,

measuring how it would have grown if that dollar mirrored

inflation, if it were invested in Treasury bills or government

bonds, or invested in either large-cap or small-cap stocks. Over

the last 92 years, stocks have provided an annual return almost

twice that of bonds and inflation.

Over this period of time, small-cap stocks had returns that

were more than twice that of government bonds. Large-cap

stocks produced returns that were close to twice the return of

government bonds. Both small-cap stocks and large-cap stocks

Chapter 3: You Must Have Growth In Your Portfolio