Page 21 - GROUP 3 NAKED HOTEL LIMITED ANNUAL REPORT

P. 21

Analysis of Asset, Liability, and Capital

Assets:

The non-current assets of Naked Hotel Limited decreased by 6.9% because equipment

costing $580 was sold. However, this was counterpoised by the purchase of an equipment

costing $810. This, along with the increase in various current assets resulted in overall increase

of 7.2% ($18,567) in total assets.

Liabilities:

The business recorded an overall decrease in liabilities even though there was increase in

current liability. Total liability decreased by 9.5% when compared to 2015.

Shareholders’ Equity

There was a 28.2% ($32,169) increase in shareholders’ equity in 2016. This increase was

predominantly due to the increased retained profit and a transfer of $5,000 to general reserve

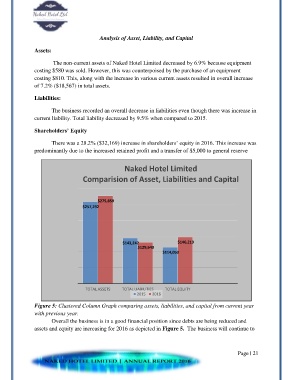

Naked Hotel Limited

Comparision of Asset, Liabilities and Capital

$275,859

$257,292

$143,242 $146,219

$129,640

$114,050

TOTAL ASSETS TOTAL LIABILITIES TOTAL EQUITY

2015 2016

Figure 5: Clustered Column Graph comparing assets, liabilities, and capital from current year

with previous year.

Overall the business is in a good financial position since debts are being reduced and

assets and equity are increasing for 2016 as depicted in Figure 5. The business will continue to

Page | 21