Page 94 - Ecobank Gambia Annual Report 2020

P. 94

Financial Statements & Annual Report

Notes to the Financial Statements

for the year ended 31 December 2020 (in Thousands of Gambian Dalasis)

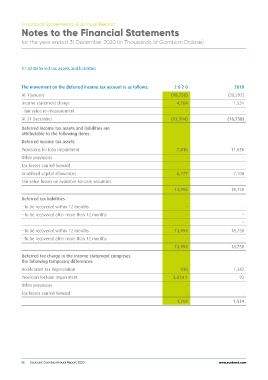

11.32 Deferred tax assets and liabilities 2020 2019

The movement on the deferred income tax account is as follows: (18,758) (20,292)

At 1 January

Income statement charge 4,764 1,534

- fair value re-measurement

At 31 December - -

Deferred income tax assets and liabilities are (13,994) (18,758)

attributable to the following items:

Deferred income tax assets 7,816 11,650

Provisions for loan impairment

Other provisions - -

Tax losses carried forward

Unutilised capital allowances - -

Fair value losses on available-for-sale securities

6,177 7,108

Deferred tax liabilities - -

- To be recovered within 12 months

- To be recovered after more than 12 months 13,994 18,758

- To be recovered within 12 months - -

- To be recovered after more than 12 months

- -

Deferred tax charge in the income statement comprises - -

the following temporary differences:

Accelerated tax depreciation 13,994 18,758

Provision for loan impairment

Other provisions - -

Tax losses carried forward

13,994 18,758

930 1,342

3,834 1 93

- -

- -

4,764 1,534

92 Ecobank Gambia Annual Report 2020 www.ecobank.com