Page 96 - Ecobank Gambia Annual Report 2020

P. 96

Financial Statements & Annual Report

Notes to the Financial Statements

for the year ended 31 December 2020 (in Thousands of Gambian Dalasis)

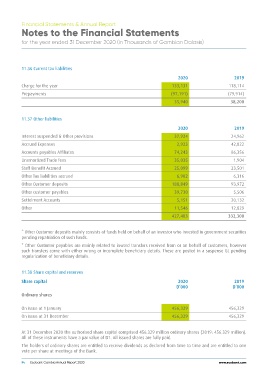

11.36 Current tax liabilities 2020 2019

133,131 118,114

(97,191) (79,914)

Charge for the year 38,200

Prepayments 35,940

11.37 Other liabilities 2020 2019

37,924 24,962

42,822

Interest suspended & Other provisions 2,923 86,356

Accrued Expenses 74,243

Accounts payables Affiliates 35,035 1,904

Unamortized Trade fees 25,099 23,501

Staff Benefit Accrued

Other Tax liabilities accrued 6,902 6,316

Other Customer deposits 188,849 93,972

Other customer payables

Settelment Accounts 39,730 5,506

Other 5,151 20,132

12,829

11,546 332,300

427,403

* Other Customer deposits mainly consists of funds held on behalf of an Investor who invested in government securities

pending repatriation of such funds.

* Other Customer payables are mainly related to inward transfers received from or on behalf of customers, however

such transfers come with either wrong or incomplete beneficiary details. These are posted in a suspense GL pending

regularization of beneficiary details.

11.38 Share capital and reserves 2020 2019

D’000 D’000

Share capital

456,329 456,329

Ordinary shares 456,329 456,329

On issue at 1 January

On issue at 31 December

At 31 December 2020 the authorised share capital comprised 456.329 million ordinary shares (2019: 456.329 million).

All of these instruments have a par value of D1. All issued shares are fully paid.

The holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one

vote per share at meetings of the Bank.

94 Ecobank Gambia Annual Report 2020 www.ecobank.com