Page 97 - Ecobank Gambia Annual Report 2020

P. 97

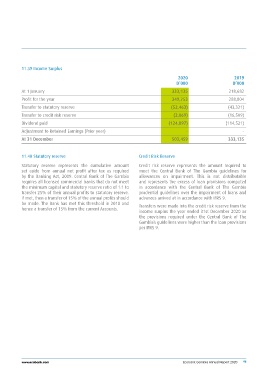

11.39 Income Surplus 2020 2019

D’000 D’000

333,135 218,682

At 1 January

Profit for the year 349,753 288,804

Transfer to statutory reserve

Transfer to credit risk reserve (52,463) (43,321)

Dividend paid

Adjustment to Retained Earnings (Prior year) (2,069) (16,509)

At 31 December

(124,897) (114,521)

- -

503,459 333,135

11.40 Statutory reserve Credit Risk Reserve

Statutory reserve represents the cumulative amount

set aside from annual net profit after tax as required Credit risk reserve represents the amount required to

by the Banking Act, 2009. Central Bank of The Gambia meet the Central Bank of The Gambia guidelines for

requires all licensed commercial banks that do not meet allowances on impairment. This is not distributable

the minimum capital and statutory reserve ratio of 1:1 to and represents the excess of loan provisions computed

transfer 25% of their annual profits to statutory reserve. in accordance with the Central Bank of The Gambia

If met, then a transfer of 15% of the annual profits should prudential guidelines over the impairment of loans and

be made. The Bank has met this threshold in 2018 and advances arrived at in accordance with IFRS 9.

hence a transfer of 15% from the current Accounts. Transfers were made into the credit risk reserve from the

income surplus the year ended 31st December 2020 as

the provisions required under the Central Bank of The

Gambia’s guidelines were higher than the loan provisions

per IFRS 9.

www.ecobank.com Ecobank Gambia Annual Report 2020 95