Page 52 - Agib Bank Limited Annual Report 2021

P. 52

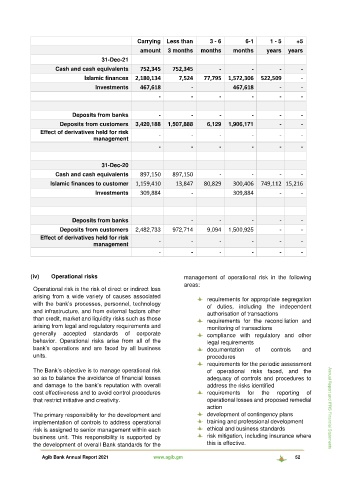

Carrying Less than 3 - 6 6-1 1 - 5 +5

amount 3 months months months years years

31-Dec-21

Cash and cash equivalents 752,345 752,345 - - - -

Islamic finances 2,180,134 7,524 77,795 1,572,306 522,509 -

Investments 467,618 - 467,618 - -

- - - - - -

Deposits from banks - - - - - -

Deposits from customers 3,420,188 1,507,888 6,129 1,906,171 - -

Effect of derivatives held for risk

management - - - - - -

- - - - - -

31-Dec-20

Cash and cash equivalents 897,150 897,150 - - - -

Islamic finances to customer 1,159,410 13,847 80,829 300,406 749,112 15,216

Investments 309,884 - 309,884 - -

Deposits from banks - - - - -

Deposits from customers 2,482,733 972,714 9,094 1,500,925 - -

Effect of derivatives held for risk - - - - - -

management

- - - - - -

(iv) Operational risks management of operational risk in the following

areas:

Operational risk is the risk of direct or indirect loss

arising from a wide variety of causes associated requirements for appropriate segregation

with the bank’s processes, personnel, technology of duties, including the independent

and infrastructure, and from external factors other authorisation of transactions

than credit, market and liquidity risks such as those requirements for the reconciliation and

arising from legal and regulatory requirements and monitoring of transactions

generally accepted standards of corporate compliance with regulatory and other

behavior. Operational risks arise from all of the legal requirements

bank’s operations and are faced by all business documentation of controls and

units. procedures

requirements for the periodic assessment

The Bank’s objective is to manage operational risk of operational risks faced, and the

so as to balance the avoidance of financial losses adequacy of controls and procedures to

and damage to the bank’s reputation with overall address the risks identified

cost effectiveness and to avoid control procedures requirements for the reporting of

that restrict initiative and creativity. operational losses and proposed remedial

action Annual Report and IFRS Financial Statements

The primary responsibility for the development and development of contingency plans

implementation of controls to address operational training and professional development

risk is assigned to senior management within each ethical and business standards

business unit. This responsibility is supported by risk mitigation, including insurance where

the development of overall Bank standards for the this is effective.

Agib Bank Annual Report 2021 www.agib.gm 52