Page 54 - Agib Bank Limited Annual Report 2021

P. 54

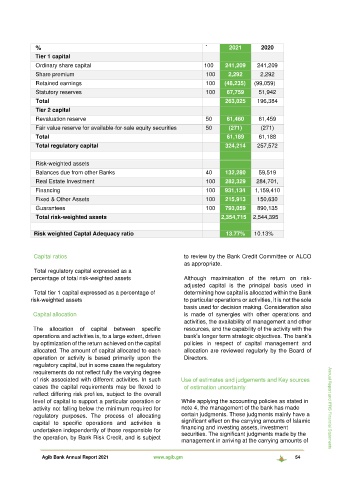

% ` 2021 2020

Tier 1 capital

Ordinary share capital 100 241,209 241,209

Share premium 100 2,292 2,292

Retained earnings 100 (48,235) (99,059)

Statutory reserves 100 67,759 51,942

Total 263,025 196,384

Tier 2 capital

Revaluation reserve 50 61,460 61,459

Fair value reserve for available-for-sale equity securities 50 (271) (271)

Total 61,189 61,188

Total regulatory capital 324,214 257,572

Risk-weighted assets

40

Balances due from other Banks 132,280 59,519

Real Estate Investment 100 282,329 284,701,

Financing 100 931,134 1,159,410

Fixed & Other Assets 100 215,913 150,630

Guarantees 100 793,059 890,135

Total risk-weighted assets 2,354,715 2,544,395

Risk weighted Captal Adequacy ratio 13.77% 10.13%

Capital ratios to review by the Bank Credit Committee or ALCO

as appropriate.

Total regulatory capital expressed as a

percentage of total risk-weighted assets Although maximisation of the return on risk-

adjusted capital is the principal basis used in

Total tier 1 capital expressed as a percentage of determining how capital is allocated within the Bank

risk-weighted assets to particular operations or activities, it is not the sole

basis used for decision making. Consideration also

Capital allocation is made of synergies with other operations and

activities, the availability of management and other

The allocation of capital between specific resources, and the capability of the activity with the

operations and activities is, to a large extent, driven bank’s longer term strategic objectives. The bank’s

by optimization of the return achieved on the capital policies in respect of capital management and

allocated. The amount of capital allocated to each allocation are reviewed regularly by the Board of

operation or activity is based primarily upon the Directors.

regulatory capital, but in some cases the regulatory

requirements do not reflect fully the varying degree

of risk associated with different activities. In such Use of estimates and judgements and Key sources

cases the capital requirements may be flexed to of estimation uncertainty

reflect differing risk profiles, subject to the overall

level of capital to support a particular operation or While applying the accounting policies as stated in

activity not falling below the minimum required for note 4, the management of the bank has made Annual Report and IFRS Financial Statements

regulatory purposes. The process of allocating certain judgments. These judgments mainly have a

capital to specific operations and activities is significant effect on the carrying amounts of Islamic

undertaken independently of those responsible for financing and investing assets, investment

securities. The significant judgments made by the

the operation, by Bank Risk Credit, and is subject

management in arriving at the carrying amounts of

Agib Bank Annual Report 2021 www.agib.gm 54