Page 59 - Agib Bank Limited Annual Report 2021

P. 59

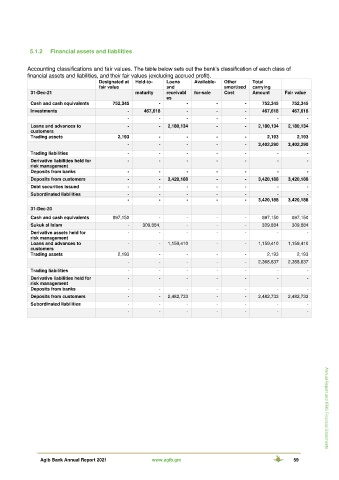

5.1.2 Financial assets and liabilities

Accounting classifications and fair values. The table below sets out the bank’s classification of each class of

financial assets and liabilities, and their fair values (excluding accrued profit).

Designated at Held-to- Loans Available- Other Total

fair value and amortised carrying

31-Dec-21 maturity receivabl for-sale Cost Amount Fair value

es

Cash and cash equivalents 752,345 - - - - 752,345 752,345

Investments - 467,618 - - - 467,618 467,618

- - - - - - -

Loans and advances to - - 2,180,134 - - 2,180,134 2,180,134

customers

Trading assets 2,193 - - - - 2,193 2,193

- - - - - 3,402,290 3,402,290

Trading liabilities - - - - - - -

Derivative liabilities held for - - - - - - -

risk management

Deposits from banks - - - - - - -

Deposits from customers - - 3,420,188 - - 3,420,188 3,420,188

Debt securities issued - - - - - - -

Subordinated liabilities - - - - - - -

- - - - - 3,420,188 3,420,188

31-Dec-20

Cash and cash equivalents 897,150 - - - - 897,150 897,150

Sukuk al Islam - 309,884, - - - 309,884 309,884

Derivative assets held for - - - - - - -

risk management

Loans and advances to - - 1,159,410 - - 1,159,410 1,159,410

customers

Trading assets 2,193 - - - - 2,193 2,193

- - - - - 2,368,637 2,368,637

Trading liabilities - - - - - - -

Derivative liabilities held for - - - - - - -

risk management

Deposits from banks - - - - - - -

Deposits from customers - - 2,482,733 - - 2,482,733 2,482,733

Subordinated liabilities - - - - - - -

- - - - - - -

Annual Report and IFRS Financial Statements

Agib Bank Annual Report 2021 www.agib.gm 59