Page 53 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 53

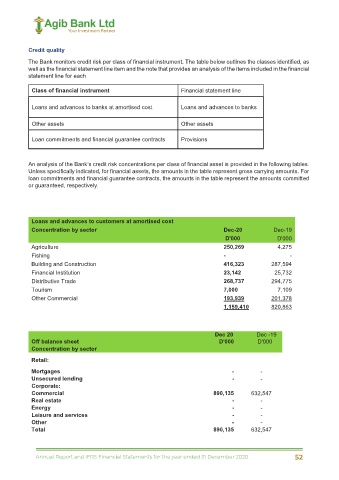

Credit quality

The Bank monitors credit risk per class of financial instrument. The table below outlines the classes identified, as

well as the financial statement line item and the note that provides an analysis of the items included in the financial

statement line for each

Class of financial instrument Financial statement line

Loans and advances to banks at amortised cost Loans and advances to banks

Other assets Other assets

Loan commitments and financial guarantee contracts Provisions

An analysis of the Bank’s credit risk concentrations per class of financial asset is provided in the following tables.

Unless specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts. For

loan commitments and financial guarantee contracts, the amounts in the table represent the amounts committed

or guaranteed, respectively.

Loans and advances to customers at amortised cost

Concentration by sector Dec-20 Dec-19

D'000 D'000

Agriculture 250,269 4,275

Fishing - -

Building and Construction 416,323 287,594

Financial Institution 23,142 25,732

Distributive Trade 268,737 294,775

Tourism 7,000 7,109

Other Commercial 193,939 201,378

1,159,410 820,863

Dec 20 Dec -19

Off balance sheet D'000 D'000

Concentration by sector

Retail:

Mortgages - -

Unsecured lending - -

Corporate:

Commercial 890,135 632,547

Real estate - -

Energy - -

Leisure and services - -

Other - -

Total 890,135 632,547

37

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 52