Page 54 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 54

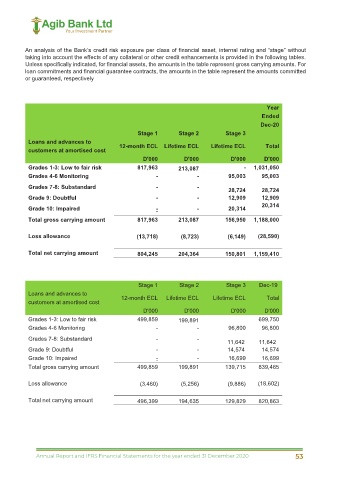

An analysis of the Bank’s credit risk exposure per class of financial asset, internal rating and “stage” without

taking into account the effects of any collateral or other credit enhancements is provided in the following tables.

Unless specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts. For

loan commitments and financial guarantee contracts, the amounts in the table represent the amounts committed

or guaranteed, respectively

Year

Ended

Dec-20

Stage 1 Stage 2 Stage 3

Loans and advances to

customers at amortised cost 12-month ECL Lifetime ECL Lifetime ECL Total

D'000 D'000 D'000 D'000

Grades 1-3: Low to fair risk 817,963 213,087 - 1,031,050

Grades 4-6 Monitoring - - 95,003 95,003

Grades 7-8: Substandard - -

28,724 28,724

Grade 9: Doubtful - - 12,909 12,909

20,314

Grade 10: Impaired - - 20,314

Total gross carrying amount 817,963 213,087 156,950 1,188,000

Loss allowance (13,718) (8,723) (6,149) (28,590)

Total net carrying amount 804,245 204,364 150,801 1,159,410

Stage 1 Stage 2 Stage 3 Dec-19

Loans and advances to

customers at amortised cost 12-month ECL Lifetime ECL Lifetime ECL Total

D'000 D'000 D'000 D'000

Grades 1-3: Low to fair risk 499,859 199,891 699,750

Grades 4-6 Monitoring - - 96,800 96,800

Grades 7-8: Substandard - -

42

11

11,642

,6

Grade 9: Doubtful - - 14,574 14,574

Grade 10: Impaired - - 16,699 16,699

Total gross carrying amount 499,859 199,891 139,715 839,465

Loss allowance (3,460) (5,256) (9,886) (18,602)

Total net carrying amount 496,399 194,635 129,829 820,863

38

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 53