Page 74 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 74

Issued ordinary shares at 1 January 25,390,495 25,390,495 Musharaka Financing 1,098 1,264

Effect of share options exercise - -

Weighted average number of ordinary shares at 31 December 25,390,495 25,390,495 Short Term Financing 112,529 138,447 42,295

Diluted earnings per share Benevolent loan 5,455 2,478 830

The calculation of diluted earnings per share at 31 December 2020 was based on the profit Deferred income (40,568) (43,586) (9,293)

attributable to ordinary shareholders of D42,856million (2019: D15.236million) and a weighted

average number of ordinary shares outstanding after adjustment for the effects of all dilutive potential

ordinary shares of 25,390,495 (2019: 25,390,495), calculated as follows:

Impairment allowance (28,590) (18,602) (5,824)

Profit attributable to ordinary shareholders (diluted)

2020 2019

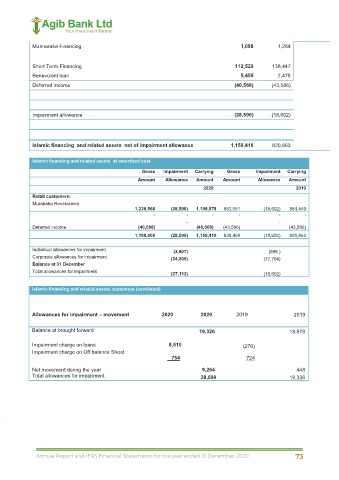

Profit for the period attributable to Islamic financing and related assets net of impairment allowance 1,159,410 820,863 820,863 466,854

ordinary shareholders 42,856 15.236

Islamic financing and related assets at amortized cost

Weighted average number of ordinary shares (diluted) Gross Impairment Carrying Gross Impairment Carrying

Amount Allowance Amount Amount Allowance Amount

Weighted average number of ordinary shares (basic) - 2020 2019

Effect of share options on issue - - Retail customers:

Weighted average number of ordinary Murabaha Receivables

shares (diluted) at 31 December 25,390,495 25,390,495 1,228,568 (28,590) 1,199,978 883,051 (18,602) 864,449

- - - - - -

18 Cash and cash equivalents Deferred income (40,568) - (40,568) (43,586) - (43,586)

1,188,000 (28,590) 1,159,410 839,465 (18,602) 820,863

2020 2019

Individual allowances for impairment (2,907)

Cash and cash equivalents Corporate allowances for impairment (24,205) (898 )

(17,704)

Cash and foreign monies 230,016 134,312 Balance at 31 December

Total allowances for impairment

Operating account with the Central Bank 667,134 179,497 (27,112) (18,602)

3 Months Sukuk Al Salaam - 45,605

Islamic financing and related assets customers (continued)

Total cash and cash equivalents 897,150 359,414

Central Bank restricted funds 126,453 55,399

Cash and Cash as per statement of cashflow 770,697 304,015 Allowances for impairment – movement 2020 2020 2019 2019

Balance at brought forward 19,326 18,878

19 Islamic financing and related assets

Impairment charge on loans 8,510 (276)

2020 2019 Impairment charge on Off balance Sheet

754 724

Islamic financing and related assets Net movement during the year 9,264 448

Total allowances for impairment

Murabaha receivables- 940,379 557,494 238,189 28,590 19,326

Ijara Financing 1,062 1,062 1,439

Istisnaa Receivables 221 235 2,311

Overdraft 79,217 97,446 114,171

Mudaraba Financing 88,607 84,625 80,834

58 59

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 73