Page 69 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 69

Regulatory requirements

The Bank is subject to the regulatory requirements of the Central Bank of the Gambia CBG, which

include limits and other restrictions pertaining to minimum capital adequacy requirements, provisioning

to cover credit risk, liquidity, interest rate, and foreign currency position.

2020 2019

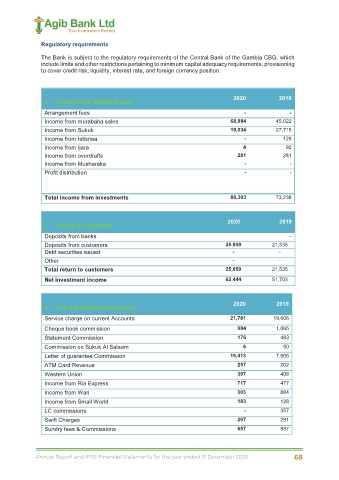

6 Income from Islamic finance

Arrangement fees - -

Income from murabaha sales 68,984 45,022

Income from Sukuk 19,034 27,715

Income from Istisnaa - 128

Income from Ijara 4 92

Income from overdrafts 281 281

Income from Musharaka - -

Profit distribution - -

Total income from investments 88,303 73,238

2020 2019

7 Return to customers

Deposits from banks -

Deposits from customers 25,859 21,535

Debt securities issued - -

Other - -

Total return to customers 25,859 21,535

Net investment income 62,444 51,703

2020 2019

8 Fee and commission income

Service charge on current Accounts 21,781 19,606

Cheque book commission 984 1,065

Statement Commission 176 483

Commission on Sukuk Al Salaam 6 50

Letter of guarantee Commission 19,413 7,905

ATM Card Revenue 257 202

Western Union 397 408

Income from Ria Express 717 477

Income from Wari 303 884

Income from Small World 183 128

LC commissions - 357

Swift Charges 297 291

Sundry fees & Commissions 657 887

54

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 68