Page 68 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 68

67

-

-

-

-

-

-

-

-

-

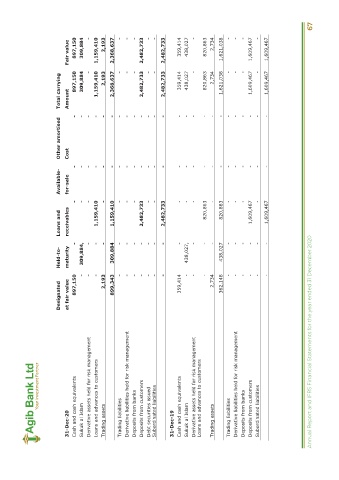

Fair value 897,150 309,884 - 1,159,410 2,193 2,368,637 2,482,733 2,482,733 359,414 438,027 - 820,863 2,734 1,621,038 1,609,467 1,609,467

- - - - - 2,734 - - - -

Total carrying Amount 897,150 309,884 - 1,159,410 2,193 2,368,637 2,482,733 2,482,733 359,414 438,027 - 820,863 1,621,038 1,609,467 1,609,467

Other amortised - - - - - - - - - - - - - - - - - - - - - - - - -

Cost

- - - - - - - - - - - - - - - - - - - - - - - - -

Available- for-sale

- - - - - - - - - - - - 820,863 - 820,863 - - - -

Loans and receivables 1,159,410 1,159,410 2,482,733 2,482,733 1,609,467 1,609,467

- - - - - - - - - - - - - - - - - - - - - 52

Held-to- maturity 309,884, - - - 309,884 - - - - - - - 438,027, - - - 438,027 - - - - - -

Designated at fair value 897,150 2,193 899,343 359,414 2,734 362,148 Annual Report and IFRS Financial Statements for the year ended 31 December 2020

Cash and cash equivalents Derivative assets held for risk management Loans and advances to customers Derivative liabilities held for risk management Deposits from banks Deposits from customers Debt securities issued Subordinated liabilities Cash and cash equivalents Derivative assets held for risk management Loans and advances to customers Derivative liabilities held for risk management Deposits from banks Deposits from cus

31-Dec-20 Sukuk al Islam Trading assets Trading liabilities 31-Dec-19 Sukuk al Islam Trading assets Trading liabilities