Page 72 - Agib Bank Ltd Annual Report and IFRS Financial statements 2020

P. 72

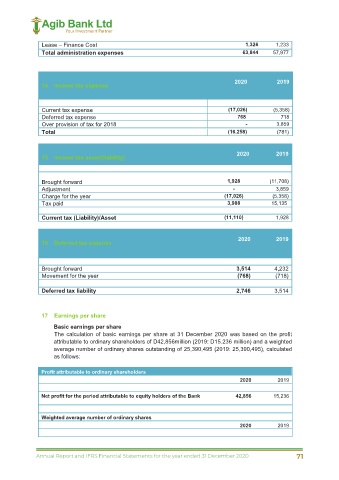

Lease – Finance Cost 1,326 1,233

Total administration expenses 63,844 57,977

2020 2019

14 Income tax expense

Current tax expense (17,026) (5,358)

Deferred tax expense 768 718

Over provision of tax for 2018 - 3,859

Total (16,258) (781)

2020 2019

15 Income tax asset/(liability)

Brought forward 1,928 (11,708)

Adjustment - 3,859

Charge for the year (17,026) (5,358)

Tax paid 3,988 15,135

Current tax (Liability)/Asset (11,110) 1,928

2020 2019

16 Deferred tax expense

Brought forward 3,514 4,232

Movement for the year (768) (718)

Deferred tax liability 2,746 3,514

17 Earnings per share

Basic earnings per share

The calculation of basic earnings per share at 31 December 2020 was based on the profit

attributable to ordinary shareholders of D42,856million (2019: D15.236 million) and a weighted

average number of ordinary shares outstanding of 25,390,495 (2019: 25,390,495), calculated

as follows:

Profit attributable to ordinary shareholders

2020 2019

Net profit for the period attributable to equity holders of the Bank 42,856 15,236

Weighted average number of ordinary shares

2020 2019

57

Annual Report and IFRS Financial Statements for the year ended 31 December 2020 71