Page 16 - Longyard - Information Memorandum_Neat

P. 16

FINANCIAL INFORMATION

The purpose of presenting the financial information in this section is to provide investors with an

overview of the expected sources and application of funds for the Syndicate and the target returns for the

Syndicate.

Whilst the Syndicate Manager is of the opinion that the target returns are based on reasonable grounds,

they may be affected by known or unknown risks and uncertainties and by changes to circumstances. The

estimated costs and targets shown may therefore differ materially from the final results ultimately

achieved for the Syndicate and Investors.

The modelling has been prepared based on a phased development of 5 phases over a 4 year term with

each phase being completed within around 9 months. The initial phase will include preliminary civil works

required for the total development. Future development costs will partially reliant on past sales but profit

distributions will be made as they are available.

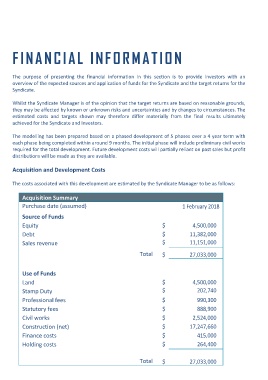

Acquisition and Development Costs

The costs associated with this development are estimated by the Syndicate Manager to be as follows:

Acquisition Summary

Purchase date (assumed) 1 February 2018

Source of Funds

Equity $ 4,500,000

Debt $ 11,382,000

Sales revenue $ 11,151,000

Total $ 27,033,000

Use of Funds

Land $ 4,500,000

Stamp Duty $ 202,740

Professional fees $ 990,300

Statutory fees $ 888,900

Civil works $ 2,524,000

Construction (net) $ 17,247,660

Finance costs $ 415,000

Holding costs $ 264,400

Total $ 27,033,000