Page 87 - Manual - Well Fixed Assets and Barcode Asset Checking

P. 87

WELL - FIXED ASSET

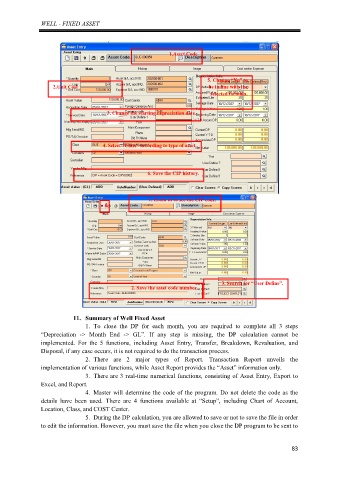

1.Asset Code

5. Change “No” to

2.Unit Cost be in line with the

selected formula.

3. Change the starting depreciation date.

4. Select “Class” according to type of asset.

6. Save the CIP history.

1. Zoom in to see the CIP code.

4

.

3. Search for “User Define”.

2. Save the asset code number.

11. Summary of Well Fixed Asset

1. To close the DP for each month, you are required to complete all 3 steps

“Depreciation -> Month End -> GL”. If any step is missing, the DP calculation cannot be

implemented. For the 5 functions, including Asset Entry, Transfer, Breakdown, Revaluation, and

Disposal, if any case occurs, it is not required to do the transaction process.

2. There are 2 major types of Report. Transaction Report unveils the

implementation of various functions, while Asset Report provides the “Asset” information only.

3. There are 3 real-time numerical functions, consisting of Asset Entry, Export to

Excel, and Report.

4. Master will determine the code of the program. Do not delete the code as the

details have been used. There are 4 functions available at “Setup”, including Chart of Account,

Location, Class, and COST Center.

5. During the DP calculation, you are allowed to save or not to save the file in order

to edit the information. However, you must save the file when you close the DP program to be sent to

83