Page 68 - Mathematics of Business and Finance

P. 68

48 Chapter 1 | Review of Basic Arithmetic

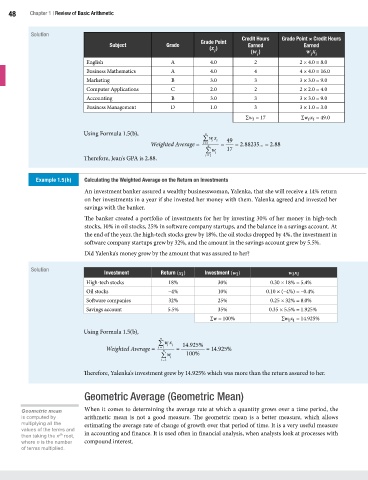

Solution

Grade Point Credit Hours Grade Point × Credit Hours

Subject Grade Earned Earned

(x ) (w ) w x

i

i i

i

English A 4.0 2 2 × 4.0 = 8.0

Business Mathematics A 4.0 4 4 × 4.0 = 16.0

Marketing B 3.0 3 3 × 3.0 = 9.0

Computer Applications C 2.0 2 2 × 2.0 = 4.0

Accounting B 3.0 3 3 × 3.0 = 9.0

Business Management D 1.0 3 3 × 1.0 = 3.0

∑w i = 17 ∑w i x i = 49.0

Using Formula 1.5(b), n

/ w i x i 49

Weighted Average = i = 1 n = = 2.88235... = 2.88

/ w i 17

Therefore, Jean's GPA is 2.88. i = 1

Example 1.5(h) Calculating the Weighted Average on the Return on Investments

An investment banker assured a wealthy businesswoman, Yalenka, that she will receive a 14% return

on her investments in a year if she invested her money with them. Yalenka agreed and invested her

savings with the banker.

The banker created a portfolio of investments for her by investing 30% of her money in high-tech

stocks, 10% in oil stocks, 25% in software company startups, and the balance in a savings account. At

the end of the year, the high-tech stocks grew by 18%, the oil stocks dropped by 4%, the investment in

software company startups grew by 32%, and the amount in the savings account grew by 5.5%.

Did Yalenka's money grow by the amount that was assured to her?

Solution

Investment Return (x i ) Investment (w i ) w i x i

High-tech stocks 18% 30% 0.30 × 18% = 5.4%

Oil stocks –4% 10% 0.10 × (–4%) = –0.4%

Software companies 32% 25% 0.25 × 32% = 8.0%

Savings account 5.5% 35% 0.35 × 5.5% = 1.925%

∑w = 100% ∑w i x i = 14.925%

Using Formula 1.5(b),

n

/ w i x i 14.925%

Weighted Average = i = 1 n = = 14.925%

/ w 100%

i = 1 i

Therefore, Yalenka's investment grew by 14.925% which was more than the return assured to her.

Geometric Average (Geometric Mean)

Geometric mean When it comes to determining the average rate at which a quantity grows over a time period, the

is computed by arithmetic mean is not a good measure. The geometric mean is a better measure, which allows

multiplying all the estimating the average rate of change of growth over that period of time. It is a very useful measure

values of the terms and

then taking the n root, in accounting and finance. It is used often in financial analysis, when analysts look at processes with

th

where n is the number compound interest.

of terms multiplied.