Page 235 - 2019 Orientation Manual

P. 235

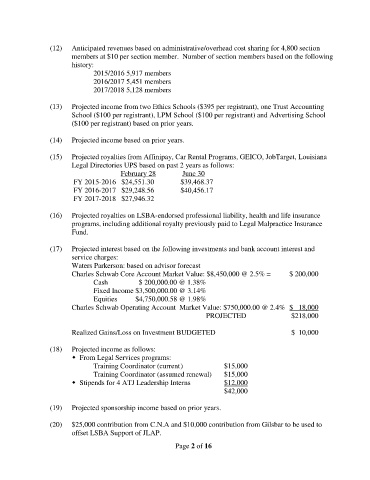

(12) Anticipated revenues based on administrative/overhead cost sharing for 4,800 section

members at $10 per section member. Number of section members based on the following

history:

2015/2016 5,917 members

2016/2017 5,451 members

2017/2018 5,128 members

(13) Projected income from two Ethics Schools ($395 per registrant), one Trust Accounting

School ($100 per registrant), LPM School ($100 per registrant) and Advertising School

($100 per registrant) based on prior years.

(14) Projected income based on prior years.

(15) Projected royalties from Affinipay, Car Rental Programs, GEICO, JobTarget, Louisiana

Legal Directories UPS based on past 2 years as follows:

February 28 June 30

FY 2015-2016 $24,551.30 $39,468.37

FY 2016-2017 $29,248.56 $40,456.17

FY 2017-2018 $27,946.32

(16) Projected royalties on LSBA-endorsed professional liability, health and life insurance

programs, including additional royalty previously paid to Legal Malpractice Insurance

Fund.

(17) Projected interest based on the following investments and bank account interest and

service charges:

Waters Parkerson: based on advisor forecast

Charles Schwab Core Account Market Value: $8,450,000 @ 2.5% = $ 200,000

Cash $ 200,000.00 @ 1.38%

Fixed Income $3,500,000.00 @ 3.14%

Equities $4,750,000.58 @ 1.98%

Charles Schwab Operating Account Market Value: $750,000.00 @ 2.4% $ 18,000

PROJECTED $218,000

Realized Gains/Loss on Investment BUDGETED $ 10,000

(18) Projected income as follows:

From Legal Services programs:

Training Coordinator (current ) $15,000

Training Coordinator (assumed renewal) $15,000

Stipends for 4 ATJ Leadership Interns $12,000

$42,000

(19) Projected sponsorship income based on prior years.

(20) $25,000 contribution from C.N.A and $10,000 contribution from Gilsbar to be used to

offset LSBA Support of JLAP.

Page 2 of 16