Page 4 - Westmark Benefit Guide 2019-2020

P. 4

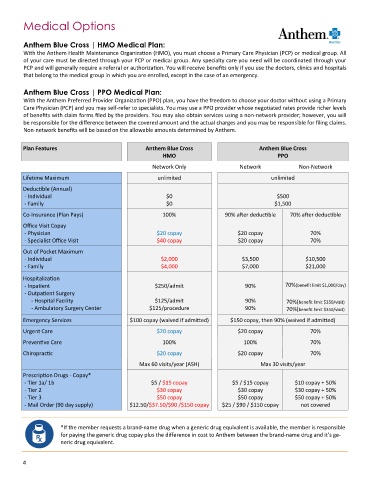

Medical Options

Anthem Blue Cross | HMO Medical Plan:

With the Anthem Health Maintenance Organization (HMO), you must choose a Primary Care Physician (PCP) or medical group. All

of your care must be directed through your PCP or medical group. Any specialty care you need will be coordinated through your

PCP and will generally require a referral or authorization. You will receive benefits only if you use the doctors, clinics and hospitals

that belong to the medical group in which you are enrolled, except in the case of an emergency.

Anthem Blue Cross | PPO Medical Plan:

With the Anthem Preferred Provider Organization (PPO) plan, you have the freedom to choose your doctor without using a Primary

Care Physician (PCP) and you may self‐refer to specialists. You may use a PPO provider whose negotiated rates provide richer levels

of benefits with claim forms filed by the providers. You may also obtain services using a non‐network provider; however, you will

be responsible for the difference between the covered amount and the actual charges and you may be responsible for filing claims.

Non-network benefits will be based on the allowable amounts determined by Anthem.

Plan Features Anthem Blue Cross Anthem Blue Cross

HMO PPO

Network Only Network Non-Network

Lifetime Maximum unlimited unlimited

Deductible (Annual)

- Individual $0 $500

- Family $0 $1,500

Co-Insurance (Plan Pays) 100% 90% after deductible 70% after deductible

Office Visit Copay

- Physician $20 copay $20 copay 70%

- Specialist Office Visit $40 copay $20 copay 70%

Out of Pocket Maximum

- Individual $2,000 $3,500 $10,500

- Family $4,000 $7,000 $21,000

Hospitalization

- Inpatient $250/admit 90% 70%(benefit limit $1,000/day)

- Outpatient Surgery

- Hospital Facility $125/admit 90% 70%(benefit limit $350/visit)

- Ambulatory Surgery Center $125/procedure 90% 70%(benefit limit $350/visit)

Emergency Services $100 copay (waived if admitted) $150 copay, then 90% (waived if admitted)

Urgent Care $20 copay $20 copay 70%

Preventive Care 100% 100% 70%

Chiropractic $20 copay $20 copay 70%

Max 60 visits/year (ASH) Max 30 visits/year

Prescription Drugs - Copay*

- Tier 1a/ 1b $5 / $15 copay $5 / $15 copay $10 copay + 50%

- Tier 2 $30 copay $30 copay $30 copay + 50%

- Tier 3 $50 copay $50 copay $50 copay + 50%

- Mail Order (90 day supply) $12.50/$37.50/$90 /$150 copay $25 / $90 / $150 copay not covered

*If the member requests a brand-name drug when a generic drug equivalent is available, the member is responsible

for paying the generic drug copay plus the difference in cost to Anthem between the brand-name drug and it’s ge-

neric drug equivalent.

4