Page 8 - United Capital EE Guide 04-17

P. 8

MEDICAL INSURANCE

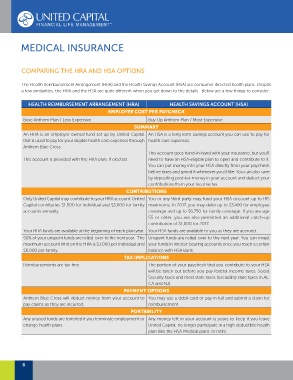

COMPARING THE HRA AND HSA OPTIONS

The Health Reimbursement Arrangement (HRA) and the Health Savings Account (HSA) are consumer directed health plans. Despite

a few similarities, the HRA and the HSA are quite different when you get down to the details. Below are a few things to consider:

HEALTH REIMBURSEMENT ARRANGEMENT (HRA) HEALTH SAVINGS ACCOUNT (HSA)

EMPLOYEE COST PER PAYCHECK

Base Anthem Plan / Less Expensive Buy-Up Anthem Plan / Most Expensive

SUMMARY

An HRA is an employer-owned fund set up by United Capital An HSA is a long-term savings account you can use to pay for

that is used to pay for your eligible health care expenses through health care expenses.

Anthem Blue Cross.

This account goes hand-in-hand with your insurance, but you’ll

This account is provided with the HRA plan, if elected. need to have an HSA-eligible plan to open and contribute to it.

You can put money into your HSA directly from your paycheck

before taxes and spend it whenever you’d like. You can also save

by depositing post-tax money in your account and deduct your

contributions from your income tax.

CONTRIBUTIONS

Only United Capital may contribute to your HRA account. United You or any third party may fund your HSA account up to IRS

Capital contributes $1,500 for individual and $3,000 for family maximums. In 2017, you may defer up to $3,400 for employee

accounts annually. coverage and up to $6,750 for family coverage. If you are age

55 or older, you are also permitted an additional catch-up

contribution of $1,000 for 2017.

Your HRA funds are available at the beginning of each plan year. Your HSA funds are available to you as they are accrued.

50% of your unspent funds are rolled-over to the next year. The Unspent funds are rolled-over to the next year. You can invest

maximum account limit on the HRA is $3,000 per individual and your funds in interest-bearing accounts once you reach a certain

$6,000 per family. balance with HSA Bank.

TAX IMPLICATIONS

Reimbursements are tax-free. The portion of your paycheck that you contribute to your HSA

will be taken out before you pay federal income taxes, Social

Security taxes and most state taxes (excluding state taxes in AL,

CA and NJ).

PAYMENT OPTIONS

Anthem Blue Cross will deduct money from your account to You may use a debit card or pay in full and submit a claim for

pay claims as they are incurred. reimbursement.

PORTABILITY

Any unused funds are forfeited if you terminate employment or Any money left in your account is yours to keep if you leave

change health plans. United Capital, no longer participate in a high deductible health

plan (like the HSA Medical plan), or retire.

:

8