Page 7 - Burlingame EE Guide 12-19 - English

P. 7

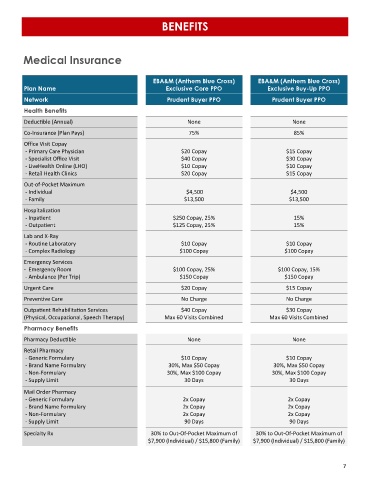

BENEFITS

Medical Insurance

EBA&M (Anthem Blue Cross) EBA&M (Anthem Blue Cross)

Plan Name Exclusive Core PPO Exclusive Buy-Up PPO

Network Prudent Buyer PPO Prudent Buyer PPO

Health Benefits

Deductible (Annual) None None

Co-Insurance (Plan Pays) 75% 85%

Office Visit Copay

- Primary Care Physician $20 Copay $15 Copay

- Specialist Office Visit $40 Copay $30 Copay

- LiveHealth Online (LHO) $10 Copay $10 Copay

- Retail Health Clinics $20 Copay $15 Copay

Out-of-Pocket Maximum

- Individual $4,500 $4,500

- Family $13,500 $13,500

Hospitalization

- Inpatient $250 Copay, 25% 15%

- Outpatient $125 Copay, 25% 15%

Lab and X-Ray

- Routine Laboratory $10 Copay $10 Copay

- Complex Radiology $100 Copay $100 Copay

Emergency Services

- Emergency Room $100 Copay, 25% $100 Copay, 15%

- Ambulance (Per Trip) $150 Copay $150 Copay

Urgent Care $20 Copay $15 Copay

Preventive Care No Charge No Charge

Outpatient Rehabilitation Services $40 Copay $30 Copay

(Physical, Occupational, Speech Therapy) Max 60 Visits Combined Max 60 Visits Combined

Pharmacy Benefits

Pharmacy Deductible None None

Retail Pharmacy

- Generic Formulary $10 Copay $10 Copay

- Brand Name Formulary 30%, Max $50 Copay 30%, Max $50 Copay

- Non-Formulary 30%, Max $100 Copay 30%, Max $100 Copay

- Supply Limit 30 Days 30 Days

Mail Order Pharmacy

- Generic Formulary 2x Copay 2x Copay

- Brand Name Formulary 2x Copay 2x Copay

- Non-Formulary 2x Copay 2x Copay

- Supply Limit 90 Days 90 Days

Specialty Rx 30% to Out-Of-Pocket Maximum of 30% to Out-Of-Pocket Maximum of

$7,900 (Individual) / $15,800 (Family) $7,900 (Individual) / $15,800 (Family)

7