Page 10 - ASMS Employee Guide 2017

P. 10

Health Savings Account

Health Savings Account (HSA): It’s as Easy as 1-2-3!

The opportunity to establish with HSA Bank and contribute to a Health Savings Bank Account is

available when you elect the HSA Medical Option.

Here’s an overview of how it works.

You can use the funds in your Health Savings Bank Account to pay tax-free for qualifying out-of-

Note pocket healthcare expenses, including your annual deductible.

Your account balance earns interest and the unused balance rolls over from year to year.

If you are unable The money is yours to keep even if you leave ASMS, no longer participate in a high deductible

to resolve your health plan (like the HSA Option) or retire.

issues or You may be able to continue to make contributions to your Health Savings Account if you enroll

questions with the in another qualified high deductible health plan (or elect COBRA continuation coverage of your

insurance carriers, HSA Option coverage) after you leave ASMS.

please contact the

Human Resources

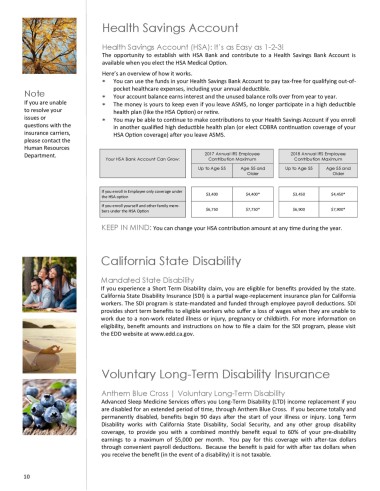

Department. 2017 Annual IRS Employee 2018 Annual IRS Employee

Your HSA Bank Account Can Grow: Contribution Maximum Contribution Maximum

Up to Age 55 Age 55 and Up to Age 55 Age 55 and

Older Older

If you enroll in Employee only coverage under $3,400 $4,400* $3,450 $4,450*

the HSA option

If you enroll yourself and other family mem-

bers under the HSA Option $6,750 $7,750* $6,900 $7,900*

KEEP IN MIND: You can change your HSA contribution amount at any time during the year.

California State Disability

Mandated State Disability

If you experience a Short Term Disability claim, you are eligible for benefits provided by the state.

California State Disability Insurance (SDI) is a partial wage-replacement insurance plan for California

workers. The SDI program is state-mandated and funded through employee payroll deductions. SDI

provides short term benefits to eligible workers who suffer a loss of wages when they are unable to

work due to a non-work related illness or injury, pregnancy or childbirth. For more information on

eligibility, benefit amounts and instructions on how to file a claim for the SDI program, please visit

the EDD website at www.edd.ca.gov.

Voluntary Long-Term Disability Insurance

Anthem Blue Cross | Voluntary Long-Term Disability

Advanced Sleep Medicine Services offers you Long-Term Disability (LTD) income replacement if you

are disabled for an extended period of time, through Anthem Blue Cross. If you become totally and

permanently disabled, benefits begin 90 days after the start of your illness or injury. Long Term

Disability works with California State Disability, Social Security, and any other group disability

coverage, to provide you with a combined monthly benefit equal to 60% of your pre-disability

earnings to a maximum of $5,000 per month. You pay for this coverage with after-tax dollars

through convenient payroll deductions. Because the benefit is paid for with after tax dollars when

you receive the benefit (in the event of a disability) it is not taxable.

10