Page 17 - Marcus & Millichap Benefit Guide 2019-2020 (revised 01.02.2020)

P. 17

Flexible Spending Accounts

PLAN YEAR: JANUARY 1, 2020 —DECEMBER 31, 2020

You can set aside money in Flexible Spending Accounts (FSA) before taxes are deducted to pay for certain health and

dependent care expenses, lowering your taxable income and increasing your take home pay. Only expenses for services

incurred during the plan year are eligible for reimbursement from your accounts. If you enrolled in a Flexible Spending

Account, you will receive a FlexToday debit card at your home address on file. You will be able to use your debit card to pay

for eligible expenses or you may submit claims to FlexToday. If you submit a claim instead of using the debit card, you will be

reimbursed by FlexToday by direct deposit or a physical check. Please note that for the Transit plan, you must use the debit

card.

Please remember that if you are using your debit card, you must save your receipts, just in case Flex Today needs a copy for

verification. Also, all receipts should be itemized to reflect what product or service was purchased. Credit card receipts are

not sufficient per IRS guidelines.

Flex Today | Medical Flexible Spending Account (Med FSA)

This plan is used to pay for expenses not covered under your health plans, such as deductibles, coinsurance, copays and

expenses that exceed plan limits. Employees may defer up to $2,750 pre‐tax in 2020.

FSAs offer sizable tax advantages. The trade‐off is that these accounts are subject to strict IRS regulations, including the use‐it

‐or‐lose‐it rule. According to this rule, up to $500 of any unspent funds remaining in your account at the end of the plan year

will carry-over to the next plan year, and unspent funds above $500 will be forfeited.

Your Med FSA account is pre-funded and your entire annual election amount is available to you on the first day of your plan

year.

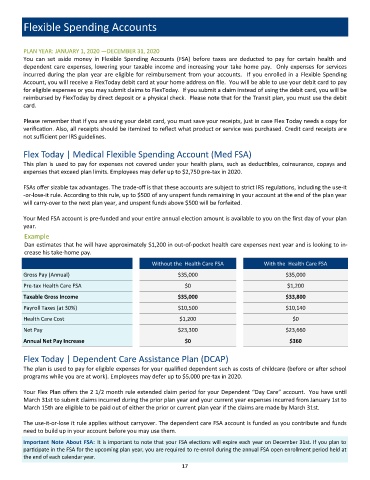

Example

Dan estimates that he will have approximately $1,200 in out-of-pocket health care expenses next year and is looking to in-

crease his take-home pay.

Without the Health Care FSA With the Health Care FSA

Gross Pay (Annual) $35,000 $35,000

Pre-tax Health Care FSA $0 $1,200

Taxable Gross Income $35,000 $33,800

Payroll Taxes (at 30%) $10,500 $10,140

Health Care Cost $1,200 $0

Net Pay $23,300 $23,660

Annual Net Pay Increase $0 $360

Flex Today | Dependent Care Assistance Plan (DCAP)

The plan is used to pay for eligible expenses for your qualified dependent such as costs of childcare (before or after school

programs while you are at work). Employees may defer up to $5,000 pre‐tax in 2020.

Your Flex Plan offers the 2 1/2 month rule extended claim period for your Dependent “Day Care” account. You have until

March 31st to submit claims incurred during the prior plan year and your current year expenses incurred from January 1st to

March 15th are eligible to be paid out of either the prior or current plan year if the claims are made by March 31st.

The use-it-or-lose it rule applies without carryover. The dependent care FSA account is funded as you contribute and funds

need to build up in your account before you may use them.

Important Note About FSA: It is important to note that your FSA elections will expire each year on December 31st. If you plan to

participate in the FSA for the upcoming plan year, you are required to re-enroll during the annual FSA open enrollment period held at

the end of each calendar year.

17