Page 21 - Marcus & Millichap Benefit Guide 2019-2020 (revised 01.02.2020)

P. 21

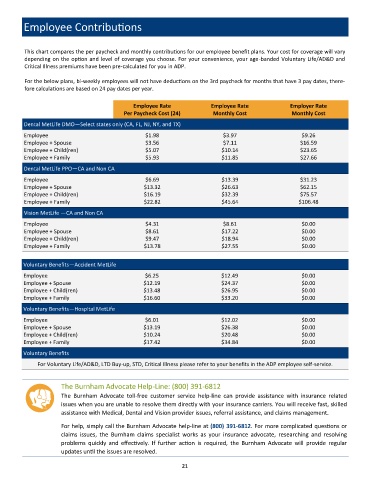

Employee Contributions

This chart compares the per paycheck and monthly contributions for our employee benefit plans. Your cost for coverage will vary

depending on the option and level of coverage you choose. For your convenience, your age-banded Voluntary Life/AD&D and

Critical Illness premiums have been pre-calculated for you in ADP.

For the below plans, bi-weekly employees will not have deductions on the 3rd paycheck for months that have 3 pay dates, there-

fore calculations are based on 24 pay dates per year.

Employee Rate Employee Rate Employer Rate

Per Paycheck Cost (24) Monthly Cost Monthly Cost

Dental MetLife DMO—Select states only (CA, FL, NJ, NY, and TX)

Employee $1.98 $3.97 $9.26

Employee + Spouse $3.56 $7.11 $16.59

Employee + Child(ren) $5.07 $10.14 $23.65

Employee + Family $5.93 $11.85 $27.66

Dental MetLife PPO—CA and Non CA

Employee $6.69 $13.39 $31.23

Employee + Spouse $13.32 $26.63 $62.15

Employee + Child(ren) $16.19 $32.39 $75.57

Employee + Family $22.82 $45.64 $106.48

Vision MetLife —CA and Non CA

Employee $4.31 $8.61 $0.00

Employee + Spouse $8.61 $17.22 $0.00

Employee + Child(ren) $9.47 $18.94 $0.00

Employee + Family $13.78 $27.55 $0.00

Voluntary Benefits—Accident MetLife

Employee $6.25 $12.49 $0.00

Employee + Spouse $12.19 $24.37 $0.00

Employee + Child(ren) $13.48 $26.95 $0.00

Employee + Family $16.60 $33.20 $0.00

Voluntary Benefits—Hospital MetLife

Employee $6.01 $12.02 $0.00

Employee + Spouse $13.19 $26.38 $0.00

Employee + Child(ren) $10.24 $20.48 $0.00

Employee + Family $17.42 $34.84 $0.00

Voluntary Benefits

For Voluntary Life/AD&D, LTD Buy-up, STD, Critical Illness please refer to your benefits in the ADP employee self-service.

The Burnham Advocate Help-Line: (800) 391-6812

The Burnham Advocate toll-free customer service help-line can provide assistance with insurance related

issues when you are unable to resolve them directly with your insurance carriers. You will receive fast, skilled

assistance with Medical, Dental and Vision provider issues, referral assistance, and claims management.

For help, simply call the Burnham Advocate help-line at (800) 391-6812. For more complicated questions or

claims issues, the Burnham claims specialist works as your insurance advocate, researching and resolving

problems quickly and effectively. If further action is required, the Burnham Advocate will provide regular

updates until the issues are resolved.

21