Page 7 - UP_Benefits_2020_CA_Support_110519_HI

P. 7

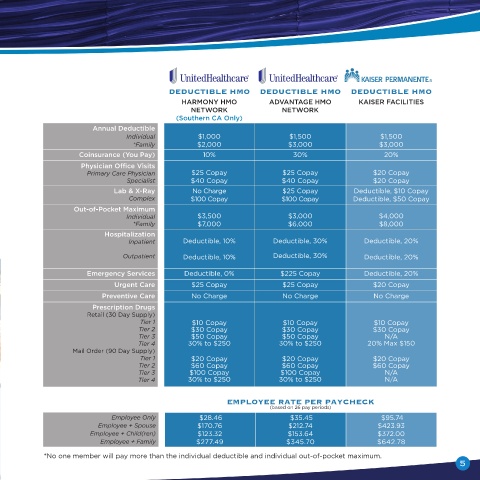

MEDICAL PLAN OPTIONS ENROLLMENT INFORMATION

UNITED HEALTHCARE DEDUCTIBLE HMO PLANS

With the United Healthcare Health Maintenance Organization (HMO) plans, you must choose a primary care physician

(PCP) or medical group within the plan’s HMO network. All of your care must be directed through your assigned PCP

or medical group. Any specialty care you need will be coordinated through your PCP and will generally require a DEDUCTIBLE HMO DEDUCTIBLE HMO DEDUCTIBLE HMO

referral or authorization. You will receive benefits only if you use the doctors, clinics and hospitals that belong to the HARMONY HMO ADVANTAGE HMO KAISER FACILITIES

medical group in which you are enrolled, except in the case of an emergency. Physician’s office visits are covered at NETWORK NETWORK

a minimal copay. Other services qualify for the applicable annual deductibles. There are two United Healthcare HMO (Southern CA Only)

plans available, with the most significant difference being the network of providers, please see the RESOURCES &

CONTACTS section of this guide to find the full network names: Annual Deductible

Individual $1,000 $1,500 $1,500

*Family $2,000 $3,000 $3,000

HARMONY NETWORK HMO: This HMO option has a lower per paycheck cost, as well as a lower deductible. To

access covered care, you must choose a primary care Physician (PCP) in the United Healthcare SignatureValue Coinsurance (You Pay) 10% 30% 20%

Harmony HMO Network, which is a narrower network of providers. Please note, the Harmony HMO Network is only Physician Office Visits

available in Southern California. Primary Care Physician $25 Copay $25 Copay $20 Copay

Specialist $40 Copay $40 Copay $20 Copay

ADVANTAGE NETWORK HMO: This HMO option has a larger network of providers. To access covered care, you Lab & X-Ray No Charge $25 Copay Deductible, $10 Copay

must choose a primary care Physician (PCP) in the United Healthcare SignatureValue Advantage HMO Network. Complex $100 Copay $100 Copay Deductible, $50 Copay

KAISER PERMANENTE DEDUCTIBLE HMO Out-of-Pocket Maximum $3,500 $3,000 $4,000

Individual

With the Kaiser Permanente Health Maintenance Organization (HMO) plan, services must be obtained at a Kaiser *Family $7,000 $6,000 $8,000

Permanente facility, except in the case of emergency. Kaiser Permanente integrates all elements of healthcare Hospitalization

such as physicians, medical centers, pharmacy and administration in one convenient facility. In addition, Kaiser Inpatient Deductible, 10% Deductible, 30% Deductible, 20%

Permanente offers online tools so you can email your doctor’s office, make appointments, refill prescriptions, and

more. Physician’s office visits, lab services, x-ray services and urgent care visits are covered at a minimal copay. Outpatient Deductible, 10% Deductible, 30% Deductible, 20%

Other services qualify for the applicable annual deductibles.

Emergency Services Deductible, 0% $225 Copay Deductible, 20%

Urgent Care $25 Copay $25 Copay $20 Copay

Preventive Care No Charge No Charge No Charge

Prescription Drugs

Retail (30 Day Supply)

Tier 1 $10 Copay $10 Copay $10 Copay

Tier 2 $30 Copay $30 Copay $30 Copay

Tier 3 $50 Copay $50 Copay N/A

Tier 4 30% to $250 30% to $250 20% Max $150

Mail Order (90 Day Supply)

Tier 1 $20 Copay $20 Copay $20 Copay

Tier 2 $60 Copay $60 Copay $60 Copay

Tier 3 $100 Copay $100 Copay N/A

Tier 4 30% to $250 30% to $250 N/A

EMPLOYEE RATE PER PAYCHECK

(based on 26 pay periods)

Employee Only $28.46 $35.45 $95.74

Employee + Spouse $170.76 $212.74 $423.93

Employee + Child(ren) $123.32 $153.64 $372.00

Employee + Family $277.49 $345.70 $642.78

*No one member will pay more than the individual deductible and individual out-of-pocket maximum.

4 5