Page 6 - Veritone EE OOS Benefit Guide_2020

P. 6

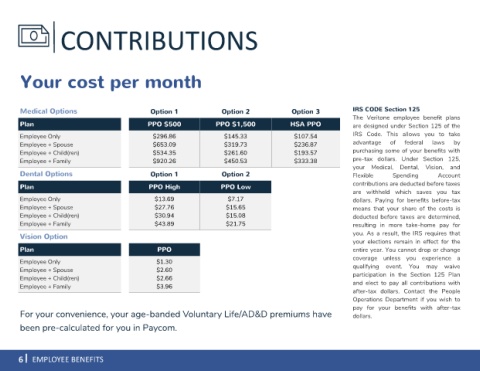

CONTRIBUTIONS

Your cost per month

Medical Options Option 1 Option 2 Option 3 IRS CODE Section 125

The Veritone employee benefit plans

Plan PPO $500 PPO $1,500 HSA PPO are designed under Section 125 of the

Employee Only $296.86 $145.33 $107.54 IRS Code. This allows you to take

Employee + Spouse $653.09 $319.73 $236.87 advantage of federal laws by

Employee + Child(ren) $534.35 $261.60 $193.57 purchasing some of your benefits with

Employee + Family $920.26 $450.53 $333.38 pre-tax dollars. Under Section 125,

your Medical, Dental, Vision, and

Dental Options Option 1 Option 2 Flexible Spending Account

Plan PPO High PPO Low contributions are deducted before taxes

are withheld which saves you tax

Employee Only $13.69 $7.17 dollars. Paying for benefits before-tax

Employee + Spouse $27.76 $15.65 means that your share of the costs is

Employee + Child(ren) $30.94 $15.08 deducted before taxes are determined,

Employee + Family $43.89 $21.75 resulting in more take-home pay for

you. As a result, the IRS requires that

Vision Option

your elections remain in effect for the

Plan PPO entire year. You cannot drop or change

coverage unless you experience a

Employee Only $1.30

Employee + Spouse $2.60 qualifying event. You may waive

Employee + Child(ren) $2.66 participation in the Section 125 Plan

Employee + Family $3.96 and elect to pay all contributions with

after-tax dollars. Contact the People

Operations Department if you wish to

pay for your benefits with after-tax

For your convenience, your age-banded Voluntary Life/AD&D premiums have dollars.

been pre-calculated for you in Paycom.

6 EMPLOYEE BENEFITS