Page 7 - Palomar EE Guide 01-19 FINAL

P. 7

Health & Wellness

Medical Benefits (continued)

POS Plan

The Point-of-Service (POS) plan offers more choice and flexibility with your care. Your coverage level is determined at the “point of service”.

Each time you obtain medical care, the level of coverage will change depending on the provider chosen and on what tier you obtain care. You

can move between tiers called Tier 1 (in-network) and Tier 2 (out-of-network). When signing up for the POS plan, you can select a Primary

Care Physician (PCP) at the time you enroll from the Sharp Health Plan Choice Network. If no PCP is selected one will be assigned to you. You

may change your PCP at any time. But remember, during the year you will have access to all tier levels at any given time.

Tier 1 In-Network Tier 2 Out-of-Network*

Tier 1 of the POS Plan operates as an HMO under the Sharp Health Plan Tier 2 of the POS plan allows you to see any licensed provider of your

Choice Network. The physician you choose as your personal doctor is choosing. However, it is recommended that you seek care from a

called your Primary Care Physician (PCP). Your PCP is responsible for contracted provider within Tier 2. In doing so you will receive most

coordinating your health care needs, including the need to be admitted to medically necessary services at 80% coverage (20% coinsurance) after

the hospital or referred to a specialist. you satisfy your deductible. Using a contracted provider in Tier 2

means there is no billing to you of any balance above the

Because your PCP knows your medical history and can direct you to the contractually agreed upon fees, saving you and your family money on

most appropriate course of treatment, it is advised that you consult with out-of-pocket costs. You can find the listing of contracted providers

and use a PCP to maximize your quality of care. on the Palomar Health intranet/benefits section.

While you can see a specialist in Tier 2 out-of-network without a referral, *If you use a Tier 2 in-network provider, you will likely save money. Non-

you will save money by going to the specialist that your PCP refers which network providers may cause you to be billed for the difference between the

will be in the Sharp Health Plan Choice Network. For most services, your approved amount and the provider’s billed amount (in addition to any

only expense will be a $30 co-pay for the PCP visit. There is no deductible applicable coinsurance or deductible).

and the plan covers preventive services at 100%. All claims are submitted

to Sharp Health Plan.

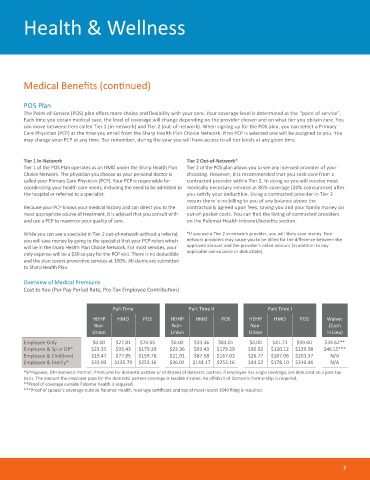

Overview of Medical Premiums

Cost to You (Per Pay Period Rate, Pre-Tax Employee Contribution)

Full-Time Part Time II Part Time I

HDHP HMO POS HDHP HMO POS HDHP HMO POS Waiver

Non- Non- Non- (Cash

Union Union Union in Lieu)

Employee Only $0.00 $27.81 $70.55 $0.00 $33.36 $83.01 $0.00 $41.71 $99.60 $34.62**

Employee & Sp or DP* $23.35 $93.43 $179.29 $23.36 $93.43 $179.29 $30.02 $120.12 $229.08 $46.15***

Employee & Child(ren) $19.47 $77.85 $159.78 $21.91 $87.58 $167.03 $26.77 $107.06 $203.37 N/A

Employee & Family* $33.93 $135.70 $253.16 $36.04 $144.17 $253.16 $44.52 $178.10 $316.46 N/A

*SP=Spouse, DP=Domestic Partner. Premiums for domestic partner or child(ren) of domestic partner, if employee has single coverage, are deducted on a post-tax

basis. The amount the employer pays for the domestic partner coverage is taxable income. An affidavit of Domestic Partnership is required.

**Proof of coverage outside Palomar Health is required.

***Proof of spouse’s coverage outside Palomar Health, marriage certificate and top of most recent 1040 filing is required.

7