Page 4 - SBCEO Benefit Guide 19-20_FINAL

P. 4

Enrollment Information 4

Changes To Enrollment

Our benefit plans are effective October 1 through September 30 of each year. There is an annual open enrollment period

each year, during which you can make new benefit elections for the following October 1 effective date. Once you make your

benefit elections, you cannot change them during the year unless you experience a qualifying event as defined by the IRS.

Examples include, but are not limited to the following:

Marriage, divorce, legal separation or annulment Change in your residence or workplace (if your benefit

Birth or adoption of a child options change)

A qualified medical child support order Loss of coverage through Medicaid or Children’s Health

Death of a spouse or child Insurance Program (CHIP)

A change in your dependent’s eligibility status Becoming eligible for a state’s premium assistance

Loss of coverage from another health plan program under Medicaid or CHIP

Significant change in income

Important Note: Coverage for a new dependent is not automatic. If you experience a qualifying event, you have 31 days

to update your coverage. Please contact the benefit office immediately following a qualifying event to complete the

appropriate election forms as needed. If you do not update your coverage within 31 days from the qualifying event, you

must wait until the next annual open enrollment period to update your coverage.

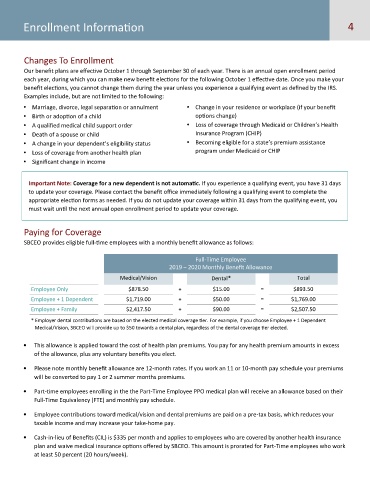

Paying for Coverage

SBCEO provides eligible full-time employees with a monthly benefit allowance as follows:

Full-Time Employee

2019 – 2020 Monthly Benefit Allowance

Medical/Vision Dental* Total

Employee Only $878.50 + $15.00 = $893.50

Employee + 1 Dependent $1,719.00 + $50.00 = $1,769.00

Employee + Family $2,417.50 + $90.00 = $2,507.50

* Employer dental contributions are based on the elected medical coverage tier. For example, if you choose Employee + 1 Dependent

Medical/Vision, SBCEO will provide up to $50 towards a dental plan, regardless of the dental coverage tier elected.

This allowance is applied toward the cost of health plan premiums. You pay for any health premium amounts in excess

of the allowance, plus any voluntary benefits you elect.

Please note monthly benefit allowance are 12-month rates. If you work an 11 or 10-month pay schedule your premiums

will be converted to pay 1 or 2 summer months premiums.

Part-time employees enrolling in the the Part-Time Employee PPO medical plan will receive an allowance based on their

Full-Time Equivalency (FTE) and monthly pay schedule.

Employee contributions toward medical/vision and dental premiums are paid on a pre-tax basis, which reduces your

taxable income and may increase your take-home pay.

Cash-in-lieu of Benefits (CIL) is $335 per month and applies to employees who are covered by another health insurance

plan and waive medical insurance options offered by SBCEO. This amount is prorated for Part-Time employees who work

at least 50 percent (20 hours/week).